8 min read

An Overview: The Axelar Ecosystem

Bridging the Blockchain Gap

Introduction:

The Axelar project is a new entrant in the web3 space which aims to revolutionize the cross-chain communication mechanisms currently in place. The creators of the project contend that the era of the internet of blockchains is only possible if important lessons from the developmental stages of the internet are drawn and applied to design similar techniques for blockchain communication. In order to achieve true interoperability between different networks, the Axelar project acknowledges the scaling issue associated with “bridges”, and proposes the idea of a universal network to handle routing translation and security on an any-to-any basis between connected blockchains. Keep reading to learn about the origins of the project, its novelties, tokenomics, prospects, and much more!

The Problem with current L1s:

The current blockchain scenario, especially the one characterized by L1 blockchains, is quite fragmented. The security guarantees that the L1 blockchains so garrulously boast about take a turn for the worse when conveyed by the existing cross-chain infrastructure. According to a report from CNBC, about ~1.4B worth of digital assets were lost to hacks on network bridges. Moreover, from a scalability perspective, bilateral bridges between N networks will require N2 bridges. This is where Axelar comes to the rescue. Axelar is a scalable cross-chain platform that aims to connect multiple blockchains and networks with different languages and provide a uniform solution to conflict-free cross-chain communication that meets the needs of both platforms and developers. Axelar’s infrastructure reflects a web3 twist in decades worth of research that led to web2 through which it enables dApp users to interact with any asset or application, on any chain, with one click. Axelar’s co-founders, Sergey Gorbunov and Georgios Vlachos, were founding team members at Algorand.

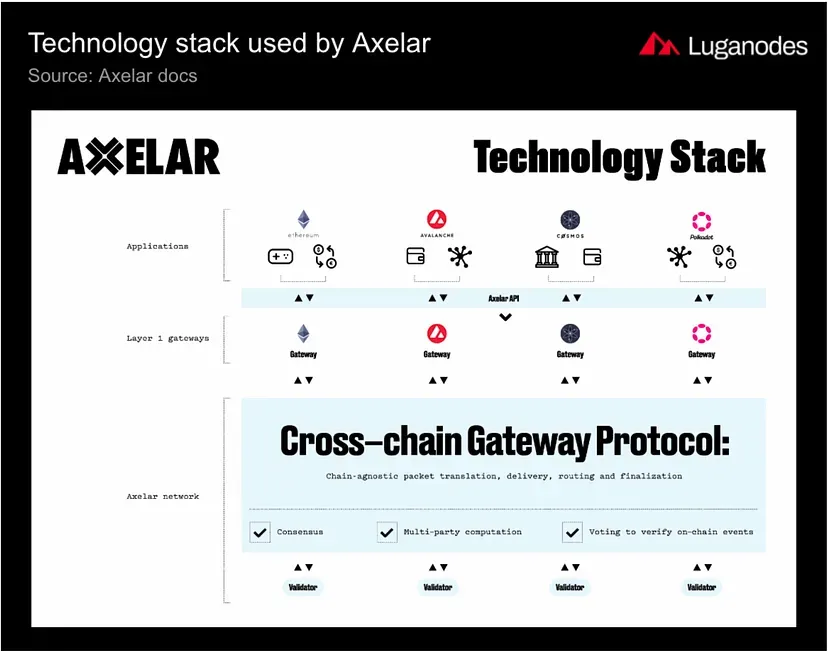

Axelar is powered by byzantine consensus, cryptography, and mechanism design protocols that let applications that operate on various blockchains communicate with each other, exposing clients to a suite of tools including a distributed network, APIs, and tools to make it easy to build cross-chain decentralized applications. As described by the Axelar team, the Axelar network is analogous to Stripe for web3. Axelar is secured using the Proof of Stake (PoS) consensus and messages from different networks are directed and translated using permissionless protocols.

The Solution:

Axelar’s solution to bilateral blockchain bridges is a network architecture that provides a uniform code base and governance structure. With these innovations and efforts to enable a unified web3 experience, Axelar hopes to onboard the next billion people onto web3.

Axelar aims to:

- Ease the process of plug-in and communication with other chains for blockchain developers

- Provide decentralized application (dApp) developers with cross-chain composability.

- Allow users to interact seamlessly with applications across multiple ecosystems.

Axelar provides seasoned software development kits for developing web3 applications that can easily be deployed on the Axelar network. In essence, Axelar envisions a web3 experience as smooth as web2, which is mostly governed by the API architecture. Axelar aims to provide a layer of abstraction between smooth cross-chain communications and the underlying networking and ecosystem-specific deployment considerations.

Axelar provides seasoned software development kits for developing web3 applications that can easily be deployed on the Axelar network. In essence, Axelar envisions a web3 experience as smooth as web2, which is mostly governed by the API architecture. Axelar aims to provide a layer of abstraction between smooth cross-chain communications and the underlying networking and ecosystem-specific deployment considerations.

With ambitious goals, Axelar recognizes the importance of accelerating its infrastructure and hence it has centered its design around two foundational decentralized protocols:

- Cross-Chain Gateway Protocol (CGP)

- Cross-chain Transfer Protocol (CTP)

CGP enforces cross-chain routing and delivery across autonomous blockchains that may run based on different consensus protocols and finality rules, heterogeneous tech stacks, and even blockchains without smart contracts. Whereas, CTP is an application-level protocol that serves as the gateway, and is responsible for allowing applications to perform simple queries via a unified API to facilitate cross-chain operations. To sum it up, decentralized apps can send CTP queries to special gateways hosted on various blockchains, and CGP is responsible for their cross-chain delivery to the correct destination blockchains, and returning the results to the sending applications.

Functional Layers of The Axelar Network:

Let us now understand the transaction life cycle of Axelar through a high-level overview. The Axelar Network comprises two functional layers:

- The Core Infrastructure Layer

- The Application Development Layer

The Core Infrastructure Layer harbors the Axelar Network itself, which is maintained by a set of validators executing transactions. The validators on the network parse the incoming transactions from the gateways of the source chain, reach a consensus, and then write to the gateway on the destination chains to execute a transaction. Upon the completion of this process, the funds involved are locked in the source chain, and an equivalent amount of canonical assets are minted on the destination chain. The Application Development Layer provides an assorted suite of SDKs and APIs, which make the core infrastructure layer of Axelar available for developers to go cross-chain. For instance, developers can lock/unlock and transfer crypto assets across chains or execute cross-application triggers through these APIs. When a user desires a cross-chain transfer of some information, he waits for the transaction or the action on the destination chain to be confirmed by the validators on chain A. Next, the Axelar validators conduct a vote on whether the transaction occurred on chain A or not. If the number of acceptances surpasses a predefined threshold, the chain A transaction is confirmed by the Axelar network. The Axelar validator set needs to sign off on a list of commands confirmed by the votes, and this signing is secured by a multi-party cryptographic algorithm. If the signatures cross the set threshold by the quadratic voting power of validators, a signed batch of commands is enforced. This set of commands is relayed to the gateway on chain B by Axelar microservices, which secures the transportation of tokens (or) data across chains.

Tokenomics:

The native token of the Axelar network is AXL. Using the AXL vouchers, users can pay the transaction fees or any other fees involved in network usage. AXL is also used for staking and exercising governance over developments on the network. The validators receive AXL tokens as rewards and incentives for their services, and since these rewards increase the circulating supply of the token, they are inflationary. The meticulous design and principles upheld by the Axelar network have backed the project capital investments from top-tier venture capitalists, like Dragonfly Capital, Polychain Capital, Coinbase, and Binance. It has also partnered with major proof-of-stake blockchains that advocate and work for interoperability, such as Avalanche, Cosmos, Ethereum, and Polkadot, among others.

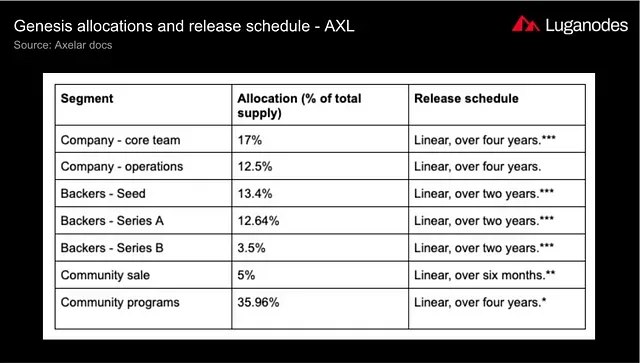

The AXL token buttresses the Axelar network and is the linchpin to its goals of security, decentralization, longevity, and ecosystem growth. In September 2022, the Axelar genesis block saw the issuance of 1 billion AXL tokens in total. They allocated to the following stakeholders and programs:

AXL is chain-agnostic, therefore its ERC-20 representations will live on all connected chains, including Ethereum. But, wAXL ticker is recommended to be used for the ERC-20 representation. 1 AXL = 1 wAXL and can be swapped by anyone via the Axelar permissionless layer via bridge front-ends such as Satellite. The unstaking process of AXL tokens takes 7 days to complete and affects your rewards. Unstaking your AXL also expends a gas fee whose amount is subject to market conditions.

AXL is chain-agnostic, therefore its ERC-20 representations will live on all connected chains, including Ethereum. But, wAXL ticker is recommended to be used for the ERC-20 representation. 1 AXL = 1 wAXL and can be swapped by anyone via the Axelar permissionless layer via bridge front-ends such as Satellite. The unstaking process of AXL tokens takes 7 days to complete and affects your rewards. Unstaking your AXL also expends a gas fee whose amount is subject to market conditions.

The AXL token has only just arrived in the crypto market, and hence carrying out a support and resistance analysis of the token is not of much value. Although, the token has managed to hold on to a humble $0.8 throughout the duration of its existence. It’s quite unusual for new projects to surface in economic conditions as volatile as those during the time of writing this article. From what the investor sentiment communicates, we stand on the cusp of a long and dry crypto winter and it will be interesting to see how the value of the network is affected going forward.

The AXL token has only just arrived in the crypto market, and hence carrying out a support and resistance analysis of the token is not of much value. Although, the token has managed to hold on to a humble $0.8 throughout the duration of its existence. It’s quite unusual for new projects to surface in economic conditions as volatile as those during the time of writing this article. From what the investor sentiment communicates, we stand on the cusp of a long and dry crypto winter and it will be interesting to see how the value of the network is affected going forward.

Axelar epitomizes innovations like Akamai and CDN which shaped the way web2 functions today and aims to translate the lessons drawn from these achievements to a seamless and secure cross-chain communication mechanism. Axelar has built a strong community around this project and continues to collaborate with big players in the industry. Recently, Axelar announced its partnership with the Layer 2 giant, Polygon Supernets to provide cross-chain interoperability. Mira Finance also teamed up with Axelar for instituting cross-chain infrastructure in its operations. Axelar and Circle also plan to enable composable USDC to natively flow cross-chain. To disseminate its vision for a unified blockchain space and to convene with industry experts to affect this shift, Axelar is also bringing the Interop Summit in February 2023. It is a providential gathering for builders creating dapps that span the whole of web3. It will bring together communities from every ecosystem for technical workshops, panels and celebrations. Axelar is centered around tried and true values of the web2 revolution. Unlike pairwise bridges, it provides a way to maintain the sanctity of the security mechanisms of L1 blockchains. We are excited to see how Axelar maneuvers through the fragments of blockchain networks and brings them all under one umbrella.

Some useful resources:

We would appreciate the reader delving deeper into the intricacies of this project and staying updated about its community through the following:

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.