9 min read

Exploring the Institutional Interest in Staking

The advent of Institutional Investors

Introduction

Ever since the Web3 world had a paradigm shift towards the Proof of Stake (PoS) consensus - staking has become the backbone of the cryptocurrency world. Staking is one of the most convenient and secure ways to invest and reap benefits from the crypto market. As with any investment opportunity, it was not long before institutional investors such as hedge funds, venture capital firms, and family offices were drawn to enterprise-grade staking.

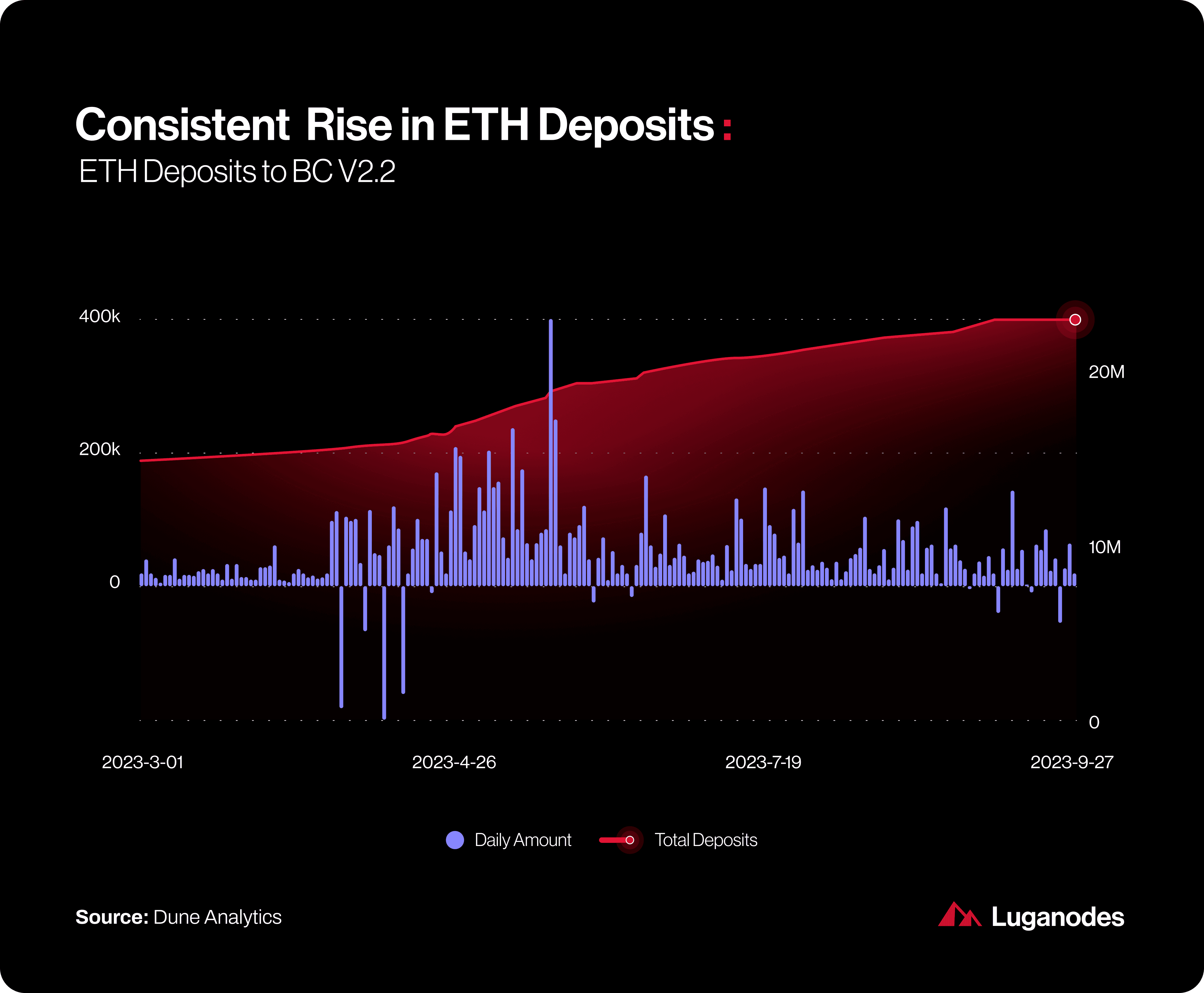

Institutional staking has become increasingly popular since the last bull run, as institutional investors have become more interested in the cryptocurrency market and the potential benefits of staking. This is good news for the Web3-verse since having stable, large investors ensure market stability, growth in the crypto market and increased security of blockchain protocols. While staking was viewed with scepticism earlier, it has now matured into a recognized opportunity for institutions to make productive use of their digital assets rather than keeping them idle.

Mutual Benefits

Institutional staking brings forth a multitude of advantages, benefiting both investors and the blockchain networks they actively support.

For Investors:

-

Passive Income Stream: Staking offers investors a reliable source of passive income, due to the inflationary nature of protocols. The amount of income generated varies based on the staked asset and the reward structure of the blockchain network.

-

Long-Term Investment Growth: Staking provides a pathway for investors to engage in the long-term growth potential of the cryptocurrency market. By participating in staking, investors contribute to the robustness of the blockchain networks that underlie their crypto assets.

-

Participation in Governance: Staking empowers investors with a voice in the governance of the blockchain networks they support. This empowerment allows them to participate in crucial decisions such as voting on network rule changes or the introduction of new features.

-

Portfolio Diversification: Staking serves as a valuable tool for diversifying investment portfolios. In the realm of cryptocurrencies, which represent a nascent and evolving risk-on asset class, staking enables investors to gain exposure without the need to actively trade their assets.

For Blockchain Networks:

-

Enhanced Security: Staking plays a pivotal role in bolstering the security of blockchain networks. It incentivizes participants to validate transactions and uphold the network's integrity, creating a robust defence against potential threats.

-

Promotion of Decentralization: Staking contributes significantly to the decentralization of blockchain networks. It acts as a countermeasure against the concentration of power in any single entity, thereby ensuring a more democratic and resilient network.

-

Efficiency Improvements: Staking mechanisms optimize the efficiency of blockchain networks. By diminishing the reliance on resource-intensive mining hardware, staking reduces operational costs and environmental impact, making the network more sustainable and scalable.

Speedbumps

While the interest in staking is increasing, it is no surprise that there is an air of reluctance shrouding the excitement. Initially, as it is with any new technology, the world needed time to understand the workings of the system. Institutional investors being highly risk-averse need time, for good reason, to test the waters before taking the leap.

Now, even as a tried and tested mechanism, staking largely faces regulatory hurdles. There is no clear standard or regulations which govern staking, making it tough to assess risks. Moreover, staking has been largely illiquid, having longer lock-in periods. For large-scale money moves, there are also tax implications, which vary from place to place. Institutions operating on a large scale must take all of these issues into consideration.

Many of these issues are slowly being solved - governments around the world are creating frameworks - such as the Markets in Crypto-Assets (MiCA) regulation in the EU.

Illiquidity of staked assets is fast becoming a thing of the past since liquid staking has gone mainstream. Since the Ethereum Shapella update, liquidity concerns have decreased as well. While all of this helps, the entry point into staking can often be steep. So there is a need to outsource the complex and technically challenging parts of these operations to staking providers. Providers who have the technical know-how, and industry experience and are highly secure. Finding a trusted provider is therefore essential.

Institutional Staking Providers

The Value Provided

Many staking providers have forayed into institutional staking. They offer services such as node operation, maintenance, and monitoring, which account for basic staking infrastructure. Site Reliability Engineers are responsible for managing these operations. Setting up a validator node involves a complex, multi-stage process that demands careful attention to detail and expertise. Therefore using a staking service to set up and maintain the infrastructure saves a lot of resources for a client. Apart from basic staking infrastructure such as these, they also provide customer support and a dedicated team taking care of custom solutions. In addition, easy-to-use user interfaces help institutions better monitor their assets and investment goals.

-

Asset custody: Institutional staking providers provide secure storage for staked assets.

-

Validator Node operation: Institutional staking providers operate and maintain the nodes required to stake assets.

-

Compliance support: Institutional staking providers can help institutional investors comply with regulatory requirements.

There are a number of staking providers that are specifically focused on institutional investors. These providers offer a range of services and features that are tailored to the needs of institutional investors, such as dedicated account managers, customised solutions and official partnerships.

Choosing a Staking Provider

While institutions are eager to utilize these providers, the plethora of options available can often be overwhelming. When choosing a staking provider, it is important to consider a number of factors, including the provider's security track record, reputation, experience, and fees. It is also recommended to pick a provider that has expertise in handling institutional clients. Some essential points to consider are as follows -

-

Reputation and Experience - A provider trusted and recognized in the market is essential. Having experience in the staking business, especially in institutional investing can provide better results.

-

Security and Control - Adhering to stringent data security measures is crucial in a world where cyber attacks are widespread. Choosing a non-custodial staking provider also grants you full control over your funds, offering an additional layer of peace of mind.

-

Uptimes and Automation - Past uptime records can provide a good estimate of the stability. Having wider geographic distribution and constant monitoring can ensure the nodes are always on. Having automation in place to handle any critical issues is a must while running nodes.

-

Support and Reporting - A round-the-clock monitoring and support team is crucial to solve any critical issues. Moreover, proper reporting about node health, staked asset value and rewards accrued is essential - as the client must be kept informed about their assets.

-

Monetary Considerations - Investors should be mindful of any associated fees and the annual return on investment. The APY rates differ between validators and chains, making them a significant factor to consider when making a choice.

-

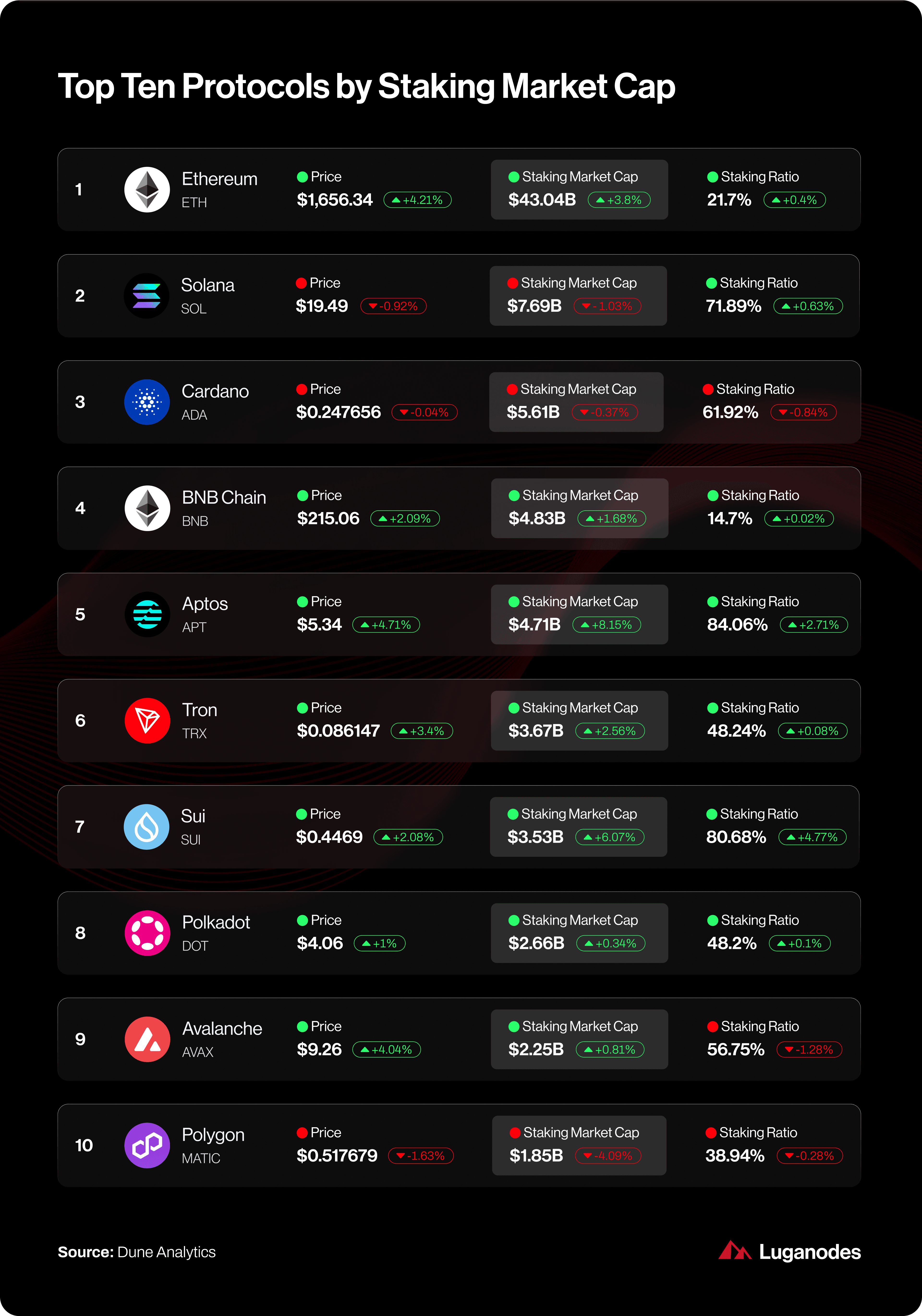

Number of Chains supported - Investors who want to invest in the cryptocurrency market should have access to staking on multiple blockchain protocols. This allows them to manage and diversify their funds, based on network performance. Having a multi-chain staking provider is of high value for this use case.

-

Governance - Participating in a blockchain by staking also involves becoming a member of the community and contributing to the security of the chain. While institutional investors may prioritize financial opportunities, it's equally vital for the validators they choose to make sound governance decisions that can have a positive impact on blockchain protocols and foster their growth.

-

Products and Services Offered - Other extra tools and services which make it easier for investors are always preferred.

-

Long-term Vision - Having common goals and values helps foster a strong partnership, and can create a fruitful business.

Taking these points into consideration, you can pick your preferred provider. Also trying to check all these boxes are staking providers like Luganodes. In terms of reputation - Luganodes is a Swiss-based blockchain infrastructure provider with a AAA rating on Staking Rewards, focusing on institutional staking. As a top validator for market leaders like Polygon and Tron, and staking partnerships with Bitfinex and CoinList; there is strong proof of trust for Luganodes, a trust also showcased the value of assets staked with Luganodes amounting to $700M+.

Luganodes happens to be non-custodial and is one of the first providers to have the triple certification of SOC2 Type II, GDPR and ISO/IEC 27001 - ensuring a strong focus on security. An uptime of 99.99%, a 24x7 Monitoring and support team, coupled with great APY rates makes Luganodes a lucrative option. Being live on 30+ networks also offers the diversification that clients require. Bells and whistles like Luganodes Terminal offer easy monitoring of assets - with more products coming soon.

Conclusion

We have witnessed the blockchain world rise, and go through peaks and troughs - only to create a stronger community which is committed to solving issues and moving to the next step. With the introduction of PoS, the protocols have become more sustainable and have opened paths to scalability. It has also opened doors to large-scale financial backing which also makes the systems more secure than ever. Institutional staking can be the threshold where Web3 technologies are widely accepted and funded. The future looks bright - for institutions, users, validators and the ecosystem as a whole.

Much like our valued partners, your organization can also take advantage of our top-tier Web3 infrastructure. As a rapidly expanding company, we are enthusiastic about forming new partnerships and cultivating enduring relationships. If our offerings resonate with your needs, please feel free to reach out to us at [email protected].

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.