6 min read

The Ethereum Merge: A Year of Sustainability and Scalability

Exploring the future paths, paved by the path

Introduction

Since its inception, Ethereum has stood out as a prominent figure in the blockchain realm, gaining widespread recognition alongside Bitcoin. It has introduced groundbreaking concepts, such as a programmable blockchain, enabling developers to construct a diverse array of decentralized applications on its platform. As the second-largest decentralized blockchain, Ethereum facilitates the development of smart contracts and decentralized applications (DApps). Throughout its journey, Ethereum has adopted an incremental approach, continually progressing on its roadmap to shape the future of Web3. Despite numerous challenges, including scalability issues and high gas fees, Ethereum is ushering in a new era with "The Merge."

The Ethereum Merge: Reflecting on a Year of Transformation

Comparing the process of The Merge to changing an engine while a car is in motion aptly illustrates the immense scale and complexity of this endeavour. Despite numerous delays and challenges, The Merge was successfully completed on September 15, 2022. This marked a watershed moment in Ethereum's evolution, transitioning from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) mechanism. This monumental shift brought about a multitude of improvements, which we will delve into in this article.

The complexity of The Merge stemmed from its fundamental alteration of Ethereum's consensus mechanism. The key objectives driving this transition included:

-

Enhanced Decentralization: By reducing hardware requirements for node operators, the transition aimed to promote a more decentralized network.

-

Accelerated Transactions: Although overall transaction speed remained comparable, the move to PoS sought to expedite transaction confirmations.

-

Environmental Efficiency: The Merge achieved an impressive 99.95% reduction in energy consumption by node validators, addressing environmental concerns.

-

Scalability: The transition paved the way for scalability solutions like sharding, poised to bolster Ethereum's capacity to process a higher volume of transactions and smart contracts.

-

Security Boost: The adoption of PoS promised heightened security through client diversity and economic incentives for validators.

-

Increased Adoption: The transition to PoS is expected to attract users who were previously deterred by environmental concerns, as well as large traditional firms seeking to invest without concerns about slower speeds and carbon footprints.

-

Economic Adjustments: The Merge aimed to curtail inflationary growth and make ETH more deflationary.

Ethereum's Post-Merge Landscape

Following the successful completion of The Merge, it is time to assess the outcomes and observe the changes in Ethereum's landscape.

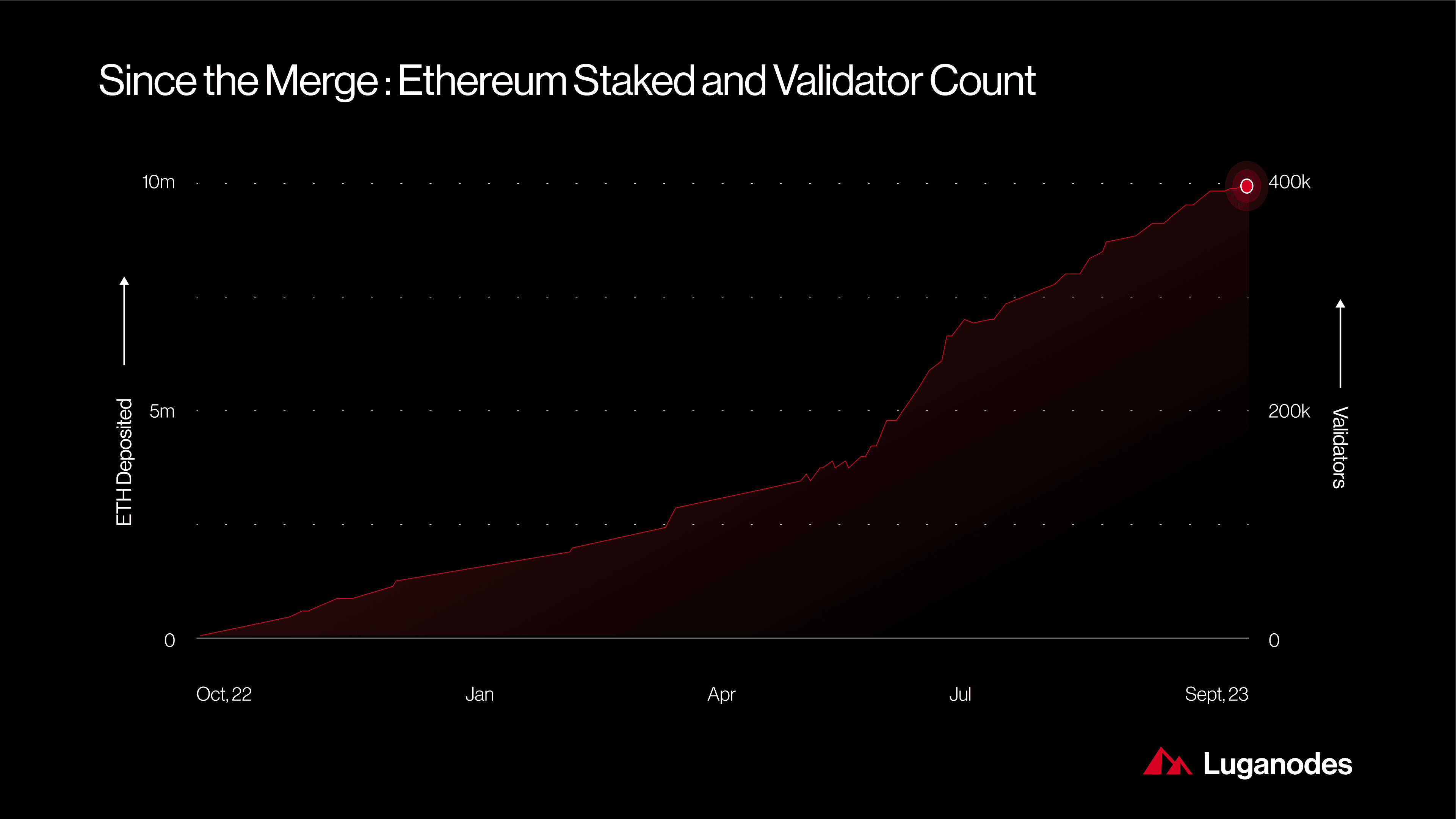

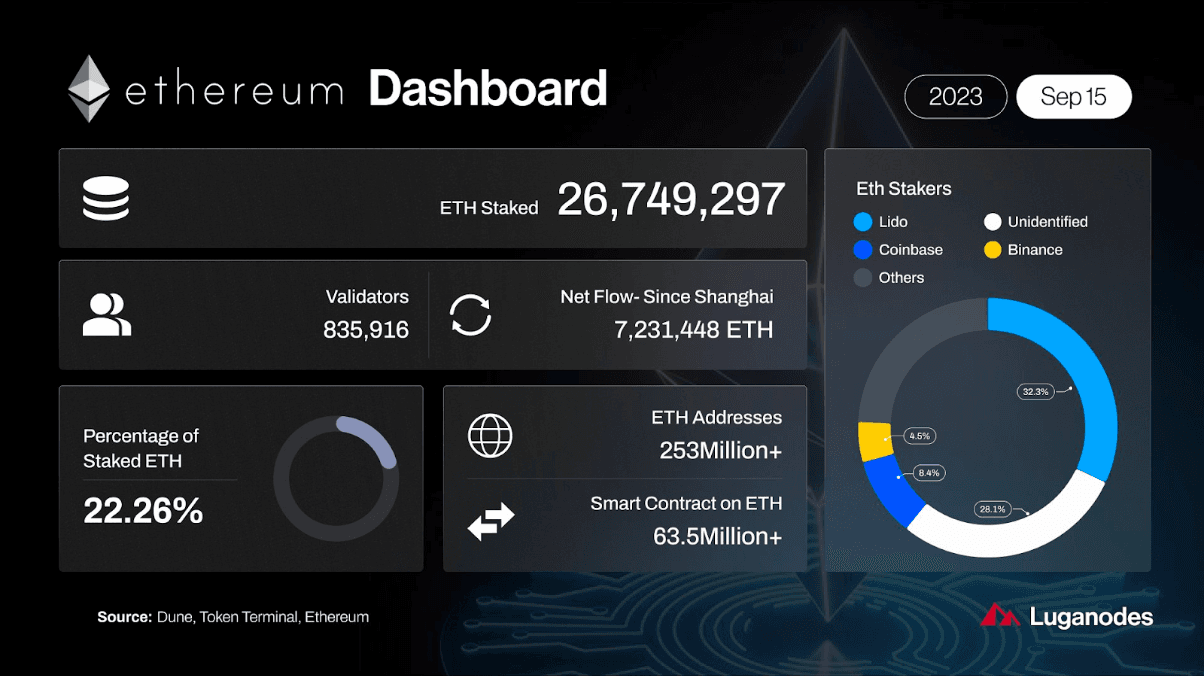

Decentralization Post-Merge, the number of validators surged dramatically, increasing from 400,000 to approximately 800,000. This influx of validators significantly enhanced the network's decentralization, with Luganodes among those providing institutional staking services.

Sustainability The adoption of a PoS system achieved remarkable environmental goals, with a 99.95% reduction in energy consumption. The Merge's impact on energy consumption is equivalent to that of a single laptop application, rendering it negligible. In contrast, if The Merge hadn't occurred, Ethereum (PoW) alone would have consumed 0.2% of the world's energy, making The Merge a crucial contributor to carbon reduction efforts.

Scalability While The Merge itself did not resolve scalability challenges and high fees, it laid the groundwork for upgrades like sharding and Verkle trees, which hold the promise of addressing these issues. Sharding will partition the blockchain to enable faster transaction processing, while Verkle trees will enhance data security and reduce storage costs, offering substantial scalability improvements when combined with Layer 2 rollups.

Security The transition to Proof of Stake has bolstered security by making it economically unfeasible for any entity to control over 51% of the network, enhancing the network's robustness. Diversification of clients further fortifies security.

Stakeholder Engagement The transition allows investors aligned with environmental, social, and governance (ESG) principles to stake their ETH tokens for passive income, free from high gas fees and mining hardware competition. This development has opened doors for institutional investors, with early indications of interest.

Economic Milestone Approximately a month after The Merge, ETH became deflationary for the first time, with more ETH burnt than created. This reduction in supply amounted to 0.13% over a week, equivalent to about 4,000 tokens. The rate of new ETH creation decreased by 90%, resulting in a net supply reduction.

Source: ultrasoundmoney

Source: ultrasoundmoney

Ethereum's Roadmap Ahead

According to Ethereum co-founder Vitalik Buterin, The Merge represents only the initial phase of multiple phases that will usher in significant changes for Ethereum. The network is currently at just 55% completion, with concurrent work on multiple phases aimed at achieving a capacity of ~100,000 transactions per second and building a digital future for humanity.

The Surge Building upon the post-Merge environment, The Surge harnesses the power of sharding to reduce data storage costs and enhance transaction throughput. Shard chains initially focus on data availability, with plans to extend their capabilities to execute code and support smart contracts. Proto-Danksharding (PDS) is set to significantly boost throughput, while Layer 2 rollups leverage shard block data to drive scalability improvements.

The Verge The Verge introduces Verkle trees, enhancing Merkle proofs and optimizing storage. These trees significantly reduce node sizes, contributing to Ethereum's scalability efforts in conjunction with sharding and rollups.

The Purge Focused on streamlining the network, The Purge removes old network history and introduces history expiration, reducing the historical data storage burden. This strategic move is expected to alleviate network congestion and enhance Ethereum's transaction throughput capacity.

The Splurge The Splurge marks the final phase, incorporating smaller yet crucial improvements to perfect Ethereum's vision of a more efficient blockchain. These advancements, described by Vitalik Buterin as the "enjoyable stuff," promise to introduce new possibilities and rules to Ethereum's network.

Conclusion

Reflecting on the journey, Ethereum's successful transition through The Merge showcases the power of community determination. What was once considered an overwhelmingly complex event was executed flawlessly, instilling hope for the future. Ethereum now stands as a leading blockchain platform, championing environmental responsibility and offering a more efficient and scalable ecosystem. The era of a decentralized digital civilization is on the horizon, promising a bright future for Ethereum and its stakeholders.

Luganodes

Ethereum’s move to a Proof of Stake, ushers a new turn in the Web3 world and as a staking service, Luganodes is ecstatic for this new chapter. Luganodes is a Swiss-operated institutional-grade non-custodial staking provider born out of Lugano Plan B Program, an initiative driven by Tether & City of Lugano. Currently, they are the world’s fastest-growing provider with AUM ~$700 million worth of staked assets live on 22+ PoS networks, including Ethereum. It is also one of the first staking providers which adheres to SOC 2 Type II compliance, GDPR and ISO 27001 certification.

If you're considering staking with Luganodes or want to learn more, we invite you to explore our website. Our services come with high uptime, attractive returns, and exceptional customer support.

We're privileged to serve prominent industry players such as Bitfinex, Coinlist Polygon, and TRON, and we take pride in being among the top validators on networks like Polygon and Tron. Just like them, your company can benefit from our world-class Web3 infrastructure. For potential partnerships, don't hesitate to reach out to us at [email protected].

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.