12 min read

Staking Enabled: The New Phase of Crypto ETFs

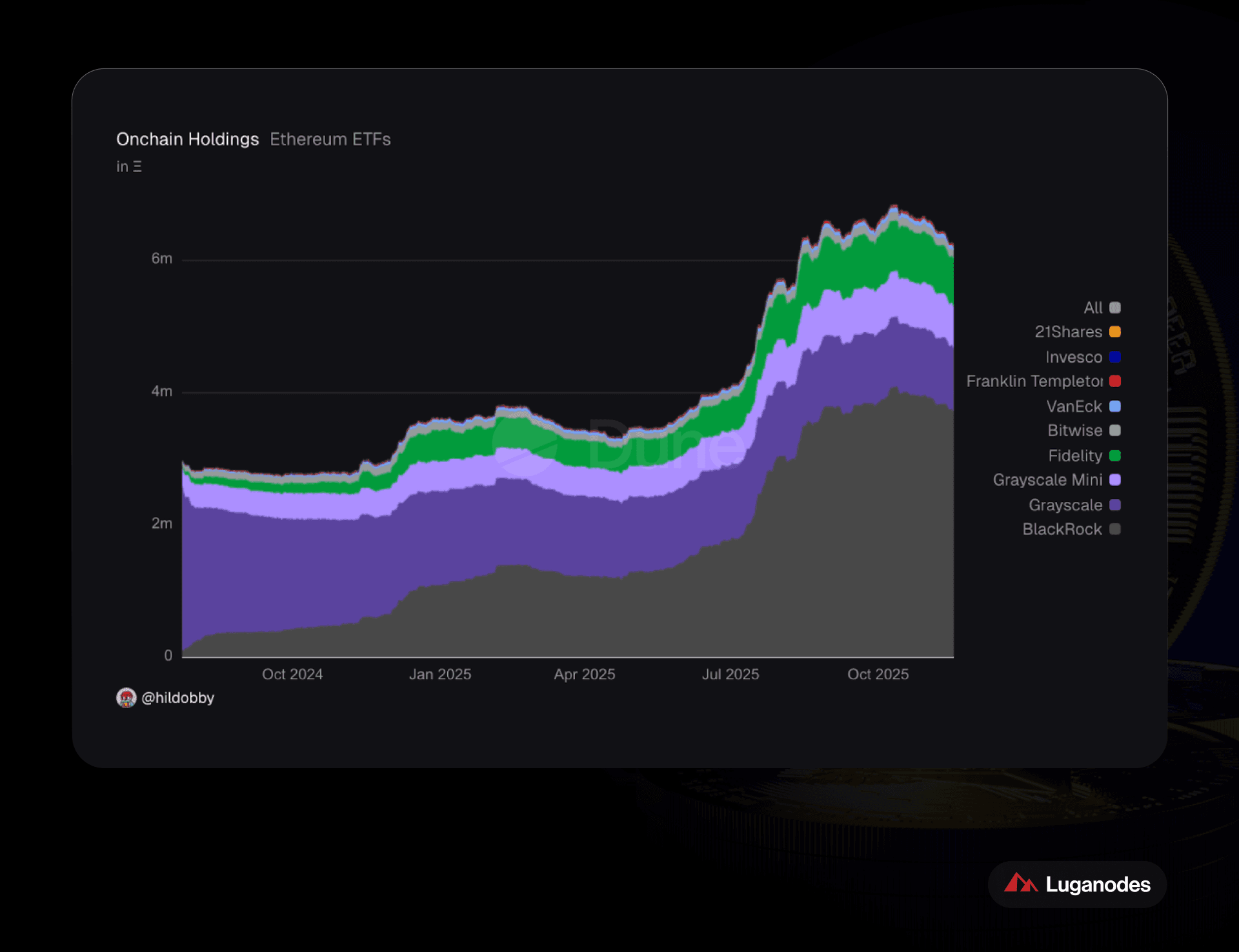

Institutional Acceleration

Introduction

The past two years have marked a turning point for digital assets within traditional finance. What began as limited exposure products, Bitcoin futures and early European crypto ETPs, has evolved into a full-spectrum marketplace for institutional-grade vehicles tracking a wide variety of blockchains.

The arrival of U.S. spot ETFs for Ethereum, Solana, and other Proof-of-Stake (PoS) assets marks a new chapter: crypto ETFs are no longer simply about tracking price. They are becoming yield-generating, staking-enabled investment products that resemble income-producing commodities or digital equivalents of dividend-paying equities.

For institutional investors, wealth managers, and ETF issuers, this shift matters for three reasons:

-

ETFs now hold billions in PoS assets that natively generate yield.

-

Regulators across major jurisdictions have clarified when and how staking may be integrated into ETFs/ETPs.

-

Issuers are beginning to compete on staking performance, fee compression, and infrastructure quality.

This report provides a comprehensive overview of the regulatory landscape, PoS chain readiness, issuer dynamics, and geographic distribution shaping the next generation of staking-enabled crypto ETFs, and why institutional-grade staking providers will sit at the center of this evolution.

Terms to Understand: A Primer for Traditional Finance

Most institutional readers will recognize ETFs, ETPs, and commodity trusts, but the crypto adaptation of these structures introduces nuances that matter for risk assessment, compliance, and product design.

Exchange-Traded Product (ETP)

A broad umbrella term covering all exchange-listed vehicles, including notes, certificates, trusts, and ETFs.

ETF (Exchange-Traded Fund)

A regulated fund structure, typically under the U.S. Investment Company Act of 1940, that offers diversification rules, board oversight, and strict investor protection requirements.

Important: Most U.S. crypto products do not use this structure.

1933 Act Commodity Trust (used by most U.S. Spot Crypto ETPs)

A passive grantor trust registered under the Securities Act of 1933.

Examples: U.S. spot Bitcoin and Ethereum products.

These trusts cannot traditionally engage in “active management,” which historically raised questions about staking eligibility.

Staking (for PoS assets)

A process where holders of a PoS token participate in network validation and earn new token rewards in exchange for securing the network.

For ETFs holding PoS assets, staking can:

-

increase NAV through reinvested rewards,

-

reduce effective management fees,

-

improve long-term performance relative to non-staked peers.

Cold Storage Custody

Institutional-grade offline custody is used by most ETPs. Staking introduces operational complexity because assets must be delegated to validators while maintaining strict security and compliance standards. Certain staking services like Luganodes offer a non-custodial offering which enables staking, without giving up custody of funds.

Regulatory Landscape: The Core Driver of ETF Staking Adoption

United States

The U.S. market is the largest and most influential venue for crypto ETFs. For staking, the key development was regulatory clarity around whether passive ETPs can stake PoS assets.

1. The Passive Trust Question

Historically, the SEC rejected staking within 1933 Act spot ETPs because staking was considered a form of “active management,” incompatible with passive trusts.

2. IRS & SEC Relief Enables Staking

Two regulatory shifts changed the picture:

-

IRS Guidance (Rev. Proc. 2025-31):

Confirmed that a grantor trust may stake PoS assets without losing its pass-through tax status, if staking is limited to custodial/administrative functions rather than active decision-making. -

SEC Staff Interpretations:

Clarified that staking performed by a third-party institutional validator may be considered “administrative” rather than “entrepreneurial,” clearing a major securities-law hurdle.

These developments opened the door for large-scale staking adoption.

3. 1940 Act ETFs

While rare in crypto, 1940 Act funds have always been allowed to stake due to their active management flexibility.

But issuers generally prefer 1933 Act structures for cost, scale, and simplicity.

Net conclusion:

The U.S. is now definitively open to staking within spot crypto ETPs, a structural shift that will shape product design for the next decade.

European Union & Switzerland

Europe has historically been the most staking-friendly jurisdiction and has effectively served as the proof-of-concept for staking-enabled crypto ETPs.

Most European products are structured as ETNs or certificates, rather than passive trusts, which removes many of the structural constraints faced by U.S. issuers. As a result, staking has been widely permissible and operationally common for years.

Issuers such as 21Shares and CoinShares have long offered staked ETH, SOL, DOT, and ADA ETPs, using staking yield both as a return enhancer and as a mechanism to offset or waive management fees. In Europe, staking is viewed as a product feature rather than a regulatory exception.

The UK’s post-ban shift further reinforces this trend. In October 2025, the FCA lifted its prohibition on retail access to crypto ETPs, allowing staking-enabled products to be held in tax-advantaged vehicles such as ISAs and SIPPs (subject to provider approval). This materially accelerates the normalization of staking yield within regulated investment wrappers.

Europe remains the most mature testing ground for staking ETF and ETP structures.

Canada

Canada was an early leader in spot crypto ETFs and among the first jurisdictions to allow staking within ETF products.

Staking is permissible but subject to stricter oversight than in Europe. Canadian regulators require clear frameworks around custody, counterparty risk, and validator due diligence to ensure investor protection. Products from issuers such as Purpose Investments demonstrated early demand for staking-enhanced ETFs, even as the U.S. market lagged behind.

While Canada’s relative share of global AUM has declined as U.S. ETFs scale, it remains an important reference point for conservative, regulator-approved staking models.

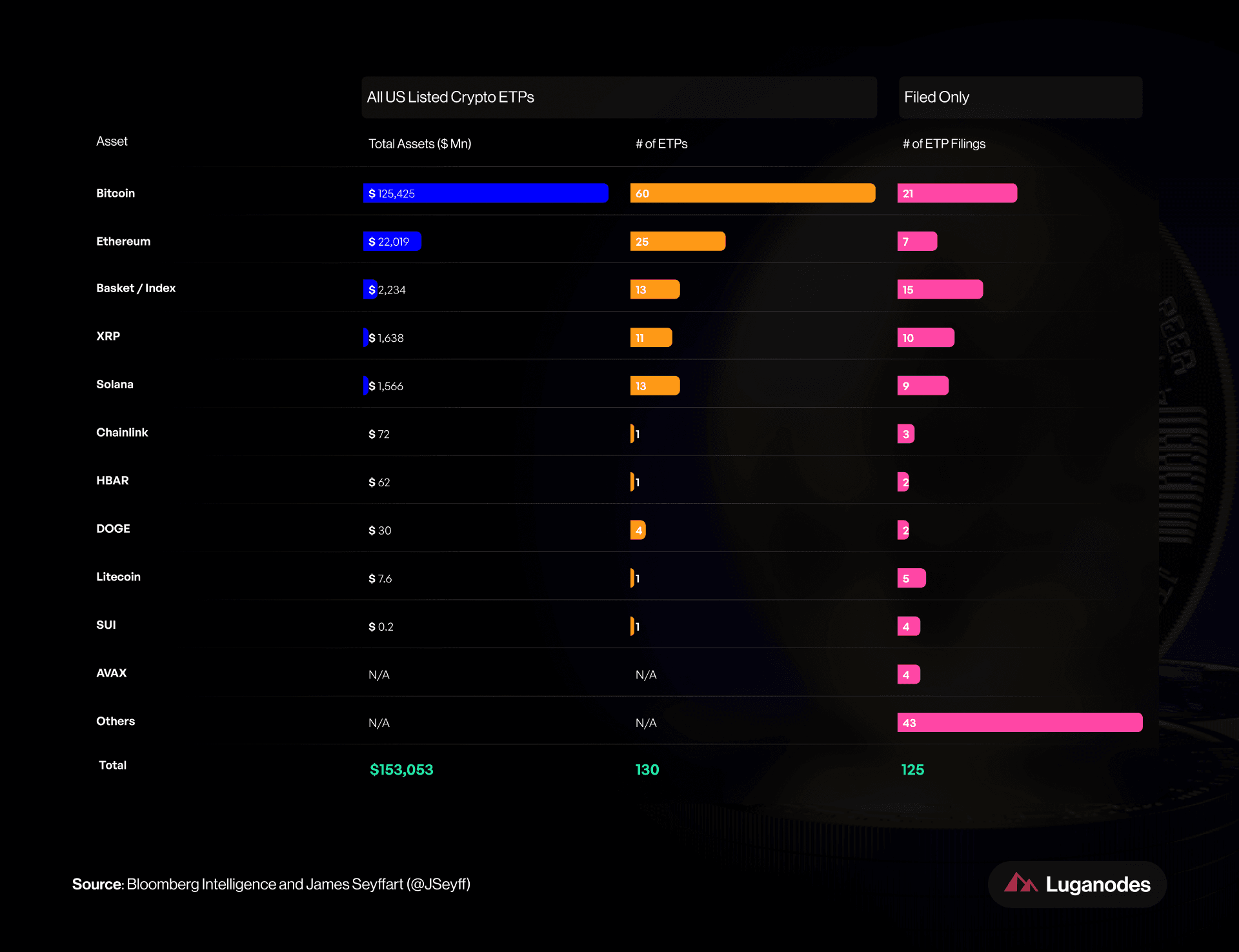

Chain Landscape

PoS chains differ significantly in yield structure, slashing risk, and validation process complexity. ETF issuers care about chains that combine liquidity, institutional narrative, and regulatory acceptance.

Ethereum (ETH)

-

Largest PoS asset held by ETFs globally (~$19B in ETP AUM).

-

U.S. spot ETH ETFs launched in 2024 and now widely stake holdings.

-

Institutional relevance: high demand for staking disclosures, MEV reporting, validator risk metrics.

Solana (SOL)

-

The first U.S. altcoin ETF to launch with mandatory staking.

-

ETF inflows have been strong, and the network has matured operationally.

-

Issuers require high-fidelity telemetry: uptime, rewards, slashing history, and chain-level incidents.

Cardano (ADA)

-

High network participation (60–70%).

-

No slashing risk; delegation-based architecture simplifies operational risk.

-

European issuers already run ADA products; U.S. filings are underway.

Polkadot (DOT)

-

Active ETP ecosystem in Europe.

-

Complex staking mechanics (nominators, validators, slashing) require strong reporting tooling.

Avalanche (AVAX)

-

U.S. spot AVAX ETF filings in progress.

-

CME futures listing strengthens institutional credibility.

-

Validators must self-stake and maintain uptime, making transparency important.

Other Relevant Chains

-

Tron (TRX): more relevant in Asia/APAC.

-

Long-tail PoS assets such as MATIC, HBAR, Sui, APT, AAVE, UNI are often included in thematic ETP baskets or high-yield experimental filings.

Non-Staking Chains

Bitcoin, Litecoin, Dogecoin, and XRP remain large contributors to total ETF AUM, though they do not interact with staking infrastructure.

Provider Landscape: Leading ETP Issuers

Many issuers exist globally, but three stand out for their pioneering role in staking-enabled ETPs and their strategic relevance.

21Shares

21Shares has spent years building Europe’s most diverse crypto ETP lineup. Their staked products (e.g., Staked ETH, DOT, SOL) were among the first globally to offer investors native blockchain yield within a regulated instrument.

Why they matter:

-

Early and aggressive adopter of staking.

-

Uses staking rewards to offset management fees.

-

Strong footprint in Switzerland, Germany, and the Nordics.

-

Operational model anticipates what U.S. issuers are only now beginning to adopt.

VanEck

VanEck bridges traditional ETF scale with crypto-native ambition. Its Solana product (VSOL) was one of the first U.S. spot ETFs to embed staking from launch.

Why they matter:

-

Longstanding SEC credibility.

-

Global 1940/1933 Act experience.

-

Clear appetite for altcoin ETFs (DOT, AVAX filings).

-

Likely to expand its PoS ETF suite, driving demand for institutional-grade staking and monitoring.

Rex Shares

Rex is producing some of the most experimental ETF filings in the U.S., including multi-asset PoS portfolios with the ability to stake up to 40% of holdings.

Why they matter:

-

Willingness to push regulatory boundaries.

-

Focus on high-yield niche assets.

-

Rapid product cycles and openness to external infrastructure partnerships.

-

Resembles leveraged/structured ETF issuers, fast-moving and innovation-first.

Bitwise

Bitwise has become a dominant voice in regulated crypto investment products, combining strong research output with investor-friendly ETF design. Their institutional commentary often shapes industry narratives, and they have publicly advocated for staking inclusion where regulation permits.

Why they matter:

-

Deep crypto-native expertise and high research credibility.

-

Strong U.S. distribution footprint across RIAs, wirehouses, and institutions.

-

Transparent operational approach - publishes methodologies, proof-of-reserves frameworks, and technical commentary.

-

A likely first mover once the SEC greenlights staking in U.S.-domiciled products.

Grayscale

Grayscale operates the largest crypto fund globally (GBTC) and is undergoing a multi-year transition into a true ETF issuer. While historically slow to adopt staking due to the trust structure, ETF conversion opens the door for redesigned product features.

Why they matter:

-

Massive AUM and brand recognition among U.S. investors.

-

Deep regulatory and litigation experience (notably the GBTC–SEC lawsuit).

-

Potential to integrate staking yields to reduce fees and restore competitiveness.

-

Their scale alone can materially impact staking demand across major PoS networks.

BlackRock

BlackRock’s entrance into crypto ETFs reset the competitive landscape. Their spot BTC ETF rapidly became one of the most successful ETF launches in history. If/when staking becomes permissible, BlackRock will introduce industrial-grade operational expectations.

Why they matter:

-

Scale and credibility unmatched among global asset managers.

-

Best-in-class risk, compliance, and operational frameworks.

-

Strategic partnerships (e.g., Coinbase) signal deeper crypto infrastructure engagement.

-

Their involvement would normalize staking as a standard ETF feature for institutional allocators.

Fidelity

Fidelity is unique among TradFi issuers: they operate their own crypto custody, mining operations, and research arm. This gives them firsthand understanding of proof-of-stake economics and infrastructure requirements.

Why they matter:

-

One of the earliest major institutions to engage deeply with crypto.

-

In-house crypto custody provides a built-in foundation for staking flows.

-

Strong intermediary distribution (retirement platforms, RIAs).

-

Ideal profile to pioneer a conservative, institution-first staking ETF once permitted.

Franklin Templeton

Franklin has taken some of the most experimental steps among large asset managers, including tokenizing money market funds and building blockchain-native operational rails.

Why they matter:

-

Willingness to launch fully on-chain financial products.

-

Active experimentation with public blockchain infrastructure (e.g., Stellar, Polygon).

-

Deep fixed-income expertise; well-suited to position staking yields as a new category of “blockchain-native income.”

-

Their mindset aligns with staking as a programmatic yield mechanism rather than a speculative feature.

Geographic Spread

Crypto ETF adoption remains geographically uneven, shaped by regulatory permissiveness and investor demographics.

United States

-

Dominates global ETF AUM.

-

Rapid expansion beyond BTC → ETH → SOL → altcoins.

-

Institutional allocators and RIAs are increasingly comfortable with crypto as a portfolio component.

Staking adoption in the U.S. will likely drive global standardization.

Europe

-

Most advanced market for altcoin and staking ETPs.

-

Long history of ETN/certificate structures enabling flexibility.

-

Recent UK regulatory shifts (lifting the retail ETP ban) will expand market depth.

Europe remains a laboratory for new product structures.

Canada

-

First region to allow spot ETFs and staking within ETFs.

-

Strong historical AUM but increasingly overshadowed by U.S. inflows.

-

Still an important market for issuers seeking to differentiate via staking and lower fees.

APAC & Latin America

-

Hong Kong is building a regional crypto ETF hub.

-

Brazil’s B3 exchange hosts several crypto ETPs with meaningful retail penetration.

-

Australia is likely to enter the staking ETF race in the coming cycle.

These markets are smaller today but may become high-growth corridors.

What Institutional ETF Issuers Look for in a Staking Provider

As staking becomes a core feature of next-generation digital asset ETFs, issuers are increasingly focused on selecting providers that can meet institutional standards across several dimensions:

-

Validator performance and reliability

-

Robust slashing-mitigation frameworks

-

Responsible MEV management practices

-

Operational sophistication across multiple chains

-

Transparent, audit-ready reporting

-

Geographic redundancy and regulatory alignment

Institutions typically evaluate partners based on their ability to deliver consistent performance, reduce operational and regulatory risk, and integrate seamlessly into established ETF workflows.

How Leading Issuers Navigate This Landscape

The providers that stand out are those offering:

-

Enterprise-Grade Reliability

High-availability validator infrastructure with automated failover, redundancy, and proven slashing-resistant architectures. -

Institutional Reporting Capabilities

Detailed, ETF-ready analytics, including uptime, MEV contribution, risk metrics, and reward breakdowns designed for NAV calculations and auditor review. -

Global, Multi-Jurisdiction Footprint

Infrastructure that spans key regulatory regions such as the U.S., EU, Switzerland, Canada, and APAC to support diversified ETF distribution. -

A Collaborative Partnership Model

Close alignment with custodians, administrators, and issuers to ensure staking operations meet compliance expectations and integrate cleanly into product workflows.

Luganodes: A Natural Fit for Institutional Staking Needs

For ETF issuers designing PoS-enabled products, or investors evaluating ETFs that incorporate native staking yield, a partner with this level of infrastructure maturity and institutional alignment becomes essential.

Luganodes is structured precisely around these requirements, making it a trusted choice for institutions seeking a secure, compliant, and scalable staking foundation.

Conclusion

The maturation of crypto ETPs marks one of the most significant developments in modern asset management:

-

U.S. regulatory clarity now allows staking within spot ETP structures.

-

Europe’s long-standing innovation is becoming the global benchmark.

-

PoS chains are evolving into yield-bearing ETF building blocks.

-

Issuers are competing not only on exposure but on staking performance, reporting sophistication, and infrastructure quality.

Staking-enabled ETFs represent the bridge between decentralized finance and traditional markets, linking native blockchain economics with regulated, liquid investment vehicles.

As billions of dollars in PoS assets flow into ETFs, the ability to provide secure, transparent, and high-performance staking becomes mission-critical. Issuers looking to differentiate their products, defend fee structures, and capture yield opportunities will partner with specialist infrastructure providers who understand both PoS networks and traditional financial requirements.

Crypto ETFs have gone beyond being an asset class, and are now helping define the future of global finance.

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.