10 min read

The Fusaka Upgrade: Stepping Into the Surge

Scaling the Ethereum Experience

Introduction

It’s that time of the year again, when we brace for the next major shift in Ethereum’s long-term roadmap. This cycle, the spotlight is firmly on the Surge, and everything is circling around a new scaling technique called PeerDAS.

Think of Fusaka as Ethereum’s next big leap toward high-volume, mainstream use: cheaper rollups, more throughput, and a better experience for the people who actually run the network.

A Quick Recap: How We Got Here

Before we talk about The Fusaka Effect, it helps to rewind to the upgrades that set the stage: Pectra and Dencun.

Pectra reshaped staking by raising the maximum effective balance per validator from 32 ETH to 2048 ETH. Instead of large operators running fleets of tiny 32 ETH validators, they can consolidate into fewer, larger ones. That reduces operational overhead, makes management simpler, and prepares the validator set for higher loads. It’s a structural tweak that doesn’t change the 32 ETH minimum, but makes the staking layer more efficient at scale.

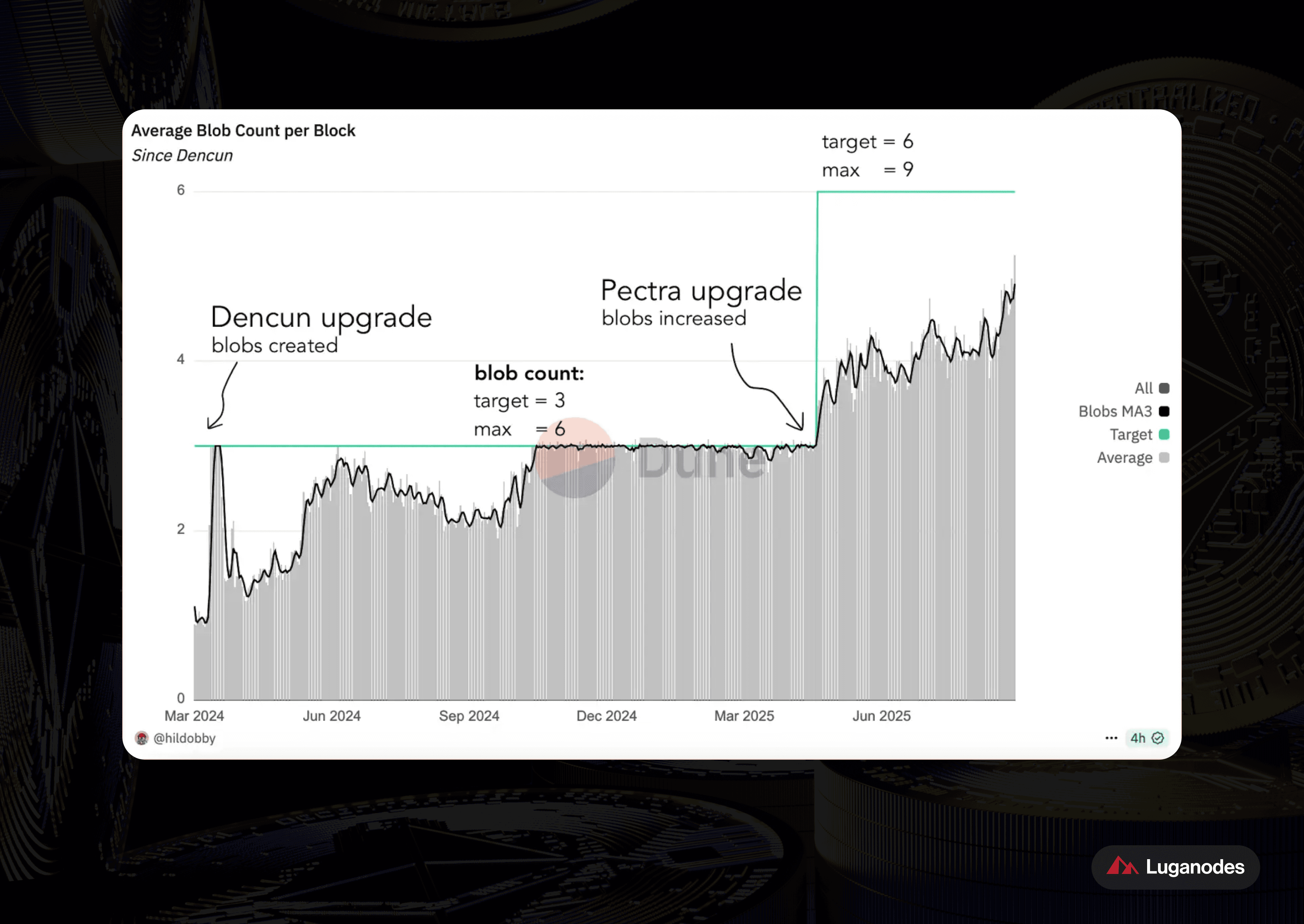

Dencun, on the other hand, went after data. It introduced blobs, a new, cheap, temporary data lane for Layer 2 rollups. Before blobs, rollups posted their data as permanent calldata, expensive, and permanently stored on-chain. With blobs, rollups get what is essentially disposable storage: post your batch, let Ethereum verify it, and then the data disappears after a short window. You can think of blobs as sticky notes for L2s: perfect for short-term storage, not meant to live forever in the archive.

The result was a huge drop in L2 fees and the real beginning of the “Surge” era.

Why does this matter for Fusaka?

-

Pectra made validators more flexible

-

Dencun gave rollups their own ephemeral data lane.

-

Fusaka builds on both: it scales blob capacity, optimizes how that data is handled, and makes sure validators aren’t overwhelmed as throughput rises.

The Four Impact Zones of Fusaka

With Fusaka, Ethereum enters its first truly serious scalability phase. The long-term ambition is on the order of ~100,000 transactions per second once you factor in Layer 2s riding on top of a more capable Layer 1.

With Fusaka, Ethereum enters its first truly serious scalability phase. The long-term ambition is on the order of ~100,000 transactions per second once you factor in Layer 2s riding on top of a more capable Layer 1.

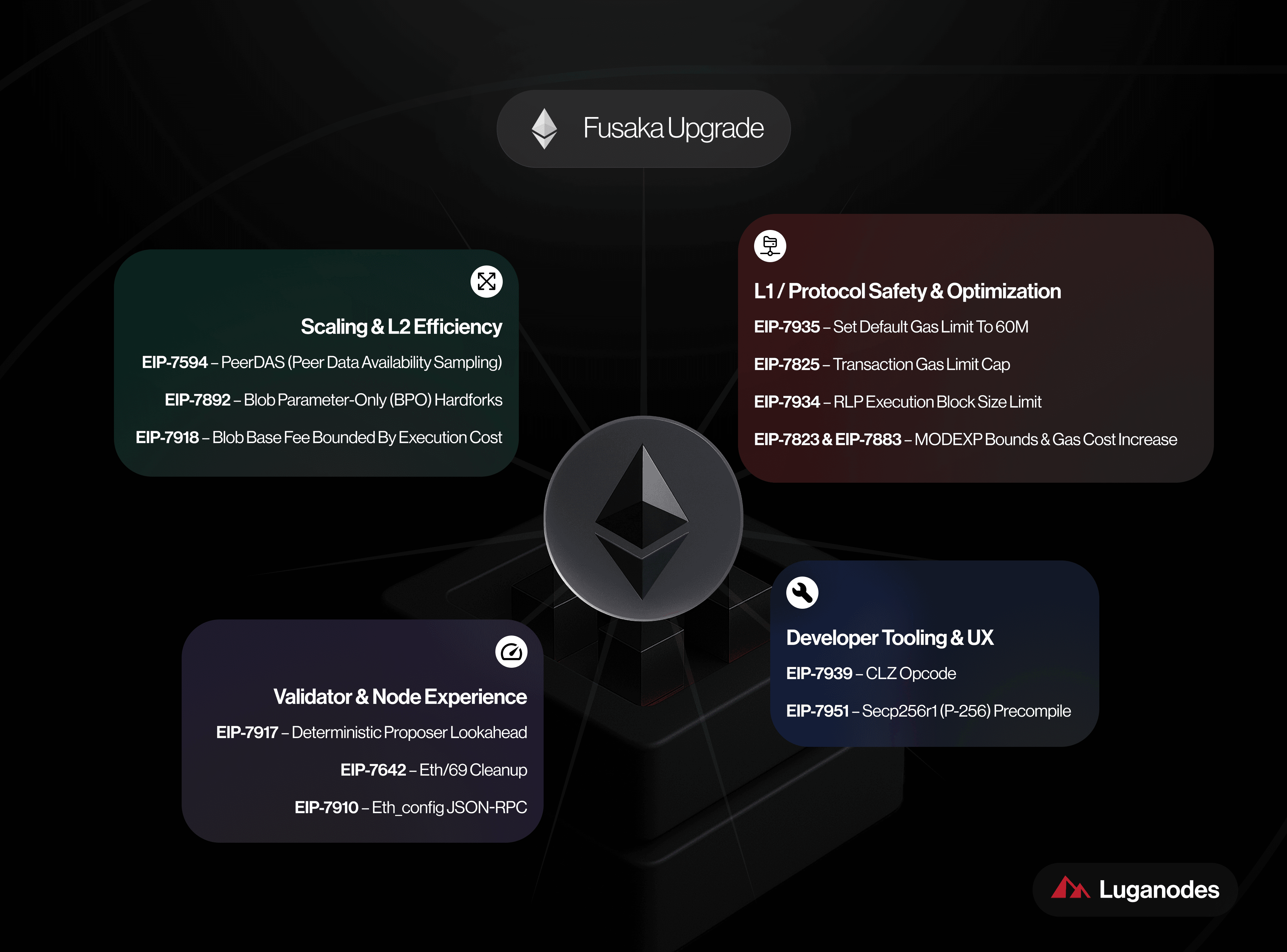

To make sense of everything Fusaka touches, it’s useful to group the changes into four “impact zones”:

-

Scaling & L2 Efficiency – the user-facing benefits: faster, cheaper, more reliable rollups.

-

L1 / Protocol Safety & Optimization – the structural upgrades that keep Ethereum secure and stable as it scales.

-

Validator & Node Experience – the practical reality for the people running the nodes.

-

Developer Tooling & UX – the building blocks that future apps and wallets will rely on.

Let’s walk through the key EIPs in each zone.

Scaling & L2 Efficiency

This is the front line of Fusaka: making L2s cheaper and more scalable without melting nodes.

EIP-7594 – PeerDAS (Peer Data Availability Sampling)

PeerDAS is the headline act. Instead of every validator downloading every blob, each validator only stores and checks a small slice — but the network still guarantees that all the data is available.

-

Roughly 8× more blob capacity.

-

Much cheaper L2 posting costs.

-

Lower data/bandwidth load for most solo stakers.

More blob space = more L2 transactions per block = cheaper and faster rollups.

EIP-7892 – Blob Parameter-Only (BPO) Hardforks

Think of this as scaling on a dimmer switch.

-

After Fusaka, devs can increase blob capacity in small, planned steps.

-

No need for a full “all hands on deck” hard fork each time.

Rollups get more room as demand grows, while client teams and validators avoid constant heavy-duty upgrade cycles.

EIP-7918 – Blob Base Fee Bounded by Execution Cost

This one keeps the blob fee market in control.

-

Prevents blob fees from collapsing to near-zero.

-

Keeps blob prices aligned with L1 gas costs.

Rollups still get cheap data, but blobs always pay a realistic “rent” for blockspace. That’s good for Ethereum’s economic security and long-term sustainability.

L1 / Protocol Safety & Optimization

These changes are the guardrails that let Ethereum safely turn the TPS dial up.

EIP-7935 – Set Default Gas Limit to 60M

More lanes on the highway.

-

Moves the default block gas limit from ~45M to ~60M.

-

Increases L1 throughput so blocks can fit more computation.

Paired with the other safety EIPs, this means more transactions per block without frying validator hardware.

EIP-7825 – Transaction Gas Limit Cap

This caps how much a single transaction can consume.

-

Max per-tx gas around 16.7M.

-

No one transaction can monopolize a full block.

This keeps blocks more balanced, improves UX (transactions don’t get starved), and gives validators more predictable worst-case workloads.

EIP-7934 – RLP Execution Block Size Limit

Gas limits control computation. 7934 caps the raw bytes.

-

Puts a ~10 MiB size limit on execution payloads.

-

Keeps blocks small enough to propagate quickly across the network.

As blob and tx capacity rises, this is a crucial safeguard against massive blocks slowing or fragmenting the network.

EIP-7823 & EIP-7883 – MODEXP Bounds & Gas Cost Increase

These two quietly fix a DoS risk in heavy cryptography.

-

Put limits on the size of inputs to the MODEXP precompile.

-

Reprice it so huge operations cost what they actually should.

That makes “weird big-number math” attacks economically pointless and clears the way for safely raising gas limits.

Validator & Node Experience

This is the part we watch closely as validators, how does running Ethereum actually feel after Fusaka?

EIP-7917 – Deterministic Proposer Lookahead

Today, the future block proposer schedule is fuzzy. 7917 locks it in and reveals it an epoch ahead.

-

Validators know who will propose upcoming blocks.

-

Enables pre-confirmations.

-

Helps MEV coordination and reduces edge-case consensus weirdness.

Net result: more predictability, smoother operations, and new UX patterns for users and L2s.

EIP-7642 – eth/69 Cleanup & EIP-7910 – eth_config JSON-RPC

Two small but meaningful QoL upgrades:

-

7642 removes pre-merge cruft from the p2p protocol, making node gossip lighter and syncs quicker.

-

7910 adds an eth_config RPC so tools can ask a node:

“Which chain config and fork schedule are you running?”

Together, they reduce configuration gotchas and make monitoring/DevOps less painful — especially at scale.

Developer Tooling & UX

These changes are lower-level, but they show up indirectly as smoother apps and better wallets.

EIP-7939 – CLZ (Count Leading Zeros) Opcode

Adds a tiny new instruction to the EVM that counts leading zero bits in a number.

-

Makes certain math and cryptographic tricks much cheaper.

-

Especially useful for zero-knowledge proofs and bit-heavy logic.

For normal users, this translates into cheaper complex operations and more room in each block for useful activity.

EIP-7951 – secp256r1 (P-256) Precompile

This is the passkey bridge.

-

Adds native support for the secp256r1 curve used by WebAuthn, phones, and hardware tokens.

-

Wallets can use device-native keys (Face ID, fingerprint, secure enclave) instead of seed phrases.

That unlocks:

-

Seedless, “login with your device” wallets.

-

Better UX for mainstream users and institutions.

-

Stronger security without sacrificing decentralization.

What Fusaka Means for Stakers and Validators

From a staking and validator perspective, Fusaka is less about changing what you do and more about changing how heavy it feels to do it.

The key change is on the hardware and bandwidth side. PeerDAS introduces a new way of assigning blob data responsibilities through custody groups.

Smaller validators in the 32–320 ETH band will only handle a fraction of total blob data, rather than downloading every blob. That reduces bandwidth and storage pressure and makes it easier to keep running a node on standard, non-exotic hardware.

Larger operators, with more stake and more validators, will cover more custody groups and therefore handle more data; but these are precisely the participants who typically already run robust infrastructure.

The design intent is clear: let Ethereum scale aggressively without turning validation into a data-center-only sport. That supports decentralization directly. Lower resource requirements mean more individuals can either start or continue running validators themselves, which in turn spreads stake and reduces reliance on a handful of large providers. Deterministic proposer lookahead fits into this story too, by making validator duties more predictable and potentially enabling future mechanisms for fairer MEV distribution.

In short, Fusaka keeps the economics of staking stable while improving the operational experience and risk profile for validators.

Impact on the Ethereum Ecosystem

Zooming out from validators, Fusaka will be felt most immediately on Layer 2s and in DeFi.

1. Layer-2s & DeFi

-

More blob capacity + PeerDAS = cheaper, higher-throughput rollups.

-

Lower fees on L2s like Arbitrum, Optimism, Base, zk-rollups, etc.

-

Faster stablecoin transfers and DEX trades.

-

Better support for high-frequency or low-size transaction flows.

Cheaper and more scalable L2s make Ethereum an even stronger settlement layer for DeFi and stablecoins.

2. User Experience & Adoption

Fusaka’s UX gains come from two angles:

-

Wallet UX:

P-256 support means passkey-style, device-native authentication becomes real on Ethereum L1. That’s a huge step toward “no seed phrase” onboarding. -

Transaction Experience:

With deterministic proposer lookahead and higher capacity, some apps will be able to offer near-instant confirmations on top of Ethereum’s 12-second block time.

Together, these make Ethereum feel more like a high-performance Web2-style platform, while still being credibly neutral and decentralized.

3. Security & Network Resilience

The L1 safety EIPs (gas caps, block size limits, repriced cryptography) all pull in the same direction:

-

Prevent single transactions or weird edge cases from bogging down the network.

-

Make worst-case scenarios more predictable for clients and validators.

-

Let Ethereum safely run with higher capacity without sacrificing robustness.

Broader Implications: Stablecoins, DeFi, and Positioning

If you zoom even further out, the story becomes about Ethereum’s position in the broader crypto and financial stack.

Cheaper, higher-throughput L2s are a direct boost for stablecoins. If sending USDC or USDT on an Ethereum rollup becomes near-instant and extremely cheap, more payments, settlements, and on-chain treasury flows become viable.

DeFi stands to benefit as well: higher capacity and cheaper rollup posting costs can lead to deeper liquidity, more frequent rebalancing, and lower slippage on DEXs, lending markets, and yield strategies.

At the same time, Fusaka reinforces Ethereum’s approach to the “blockchain trilemma”. Instead of chasing raw TPS by centralizing validators or raising hardware requirements sky-high, it leans into rollups plus carefully engineered L1 changes. That’s a message to institutions and long-term holders: Ethereum is scaling deliberately, without cutting the legs out from under decentralization.

Conclusion: Welcome to the Surge

Fusaka is a structural upgrade that enables the next stage of Ethereum’s growth. PeerDAS and the surrounding EIPs push Ethereum into a new bandwidth regime for rollups, while the safety and UX improvements make that extra power usable and sustainable.

Fusaka lands as part of the Surge, and it won’t be the last step, upgrades like “Glamsterdam” are already on the horizon. But this upgrade is a clear milestone: Ethereum is scaling up, not by sacrificing its values, but by leaning into them.

From our perspective as validators, it’s a moment to both contribute and pay attention. We keep our infrastructure ready, participate in securing the network, and watch as the next phase of Ethereum’s roadmap becomes reality.

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.