10 min read

Ethereum Treasuries: Yield-Bearing Corporate Reserves

Redefining Corporate Finance

Introduction

Ethereum has hit a major all-time high this year, an event that coincides closely with its institutional adoption and the entry of large traditional finance players into Web3. With cryptocurrencies more mainstream than ever, more players are aiming to create liquidity reserves of cryptocurrencies.

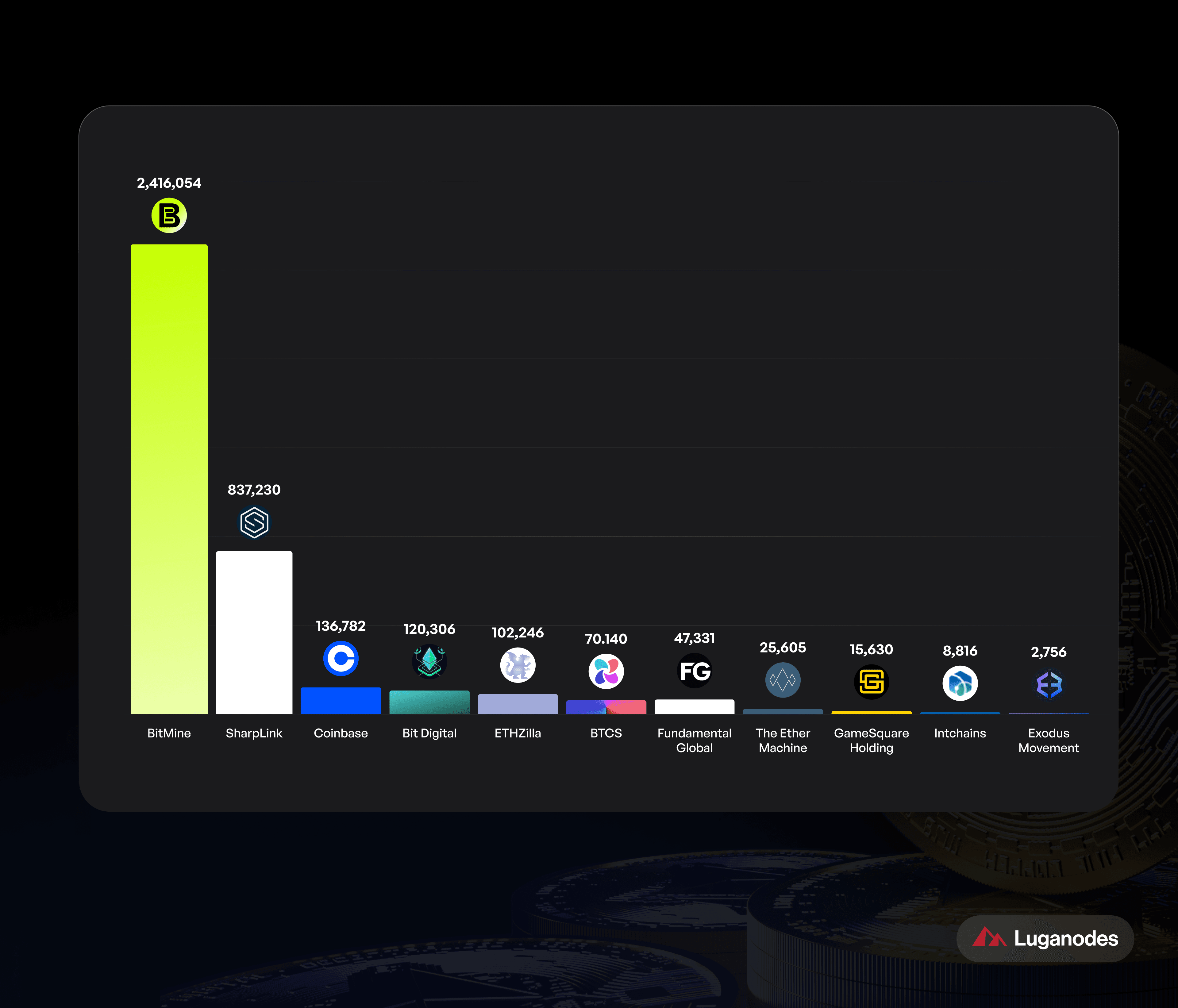

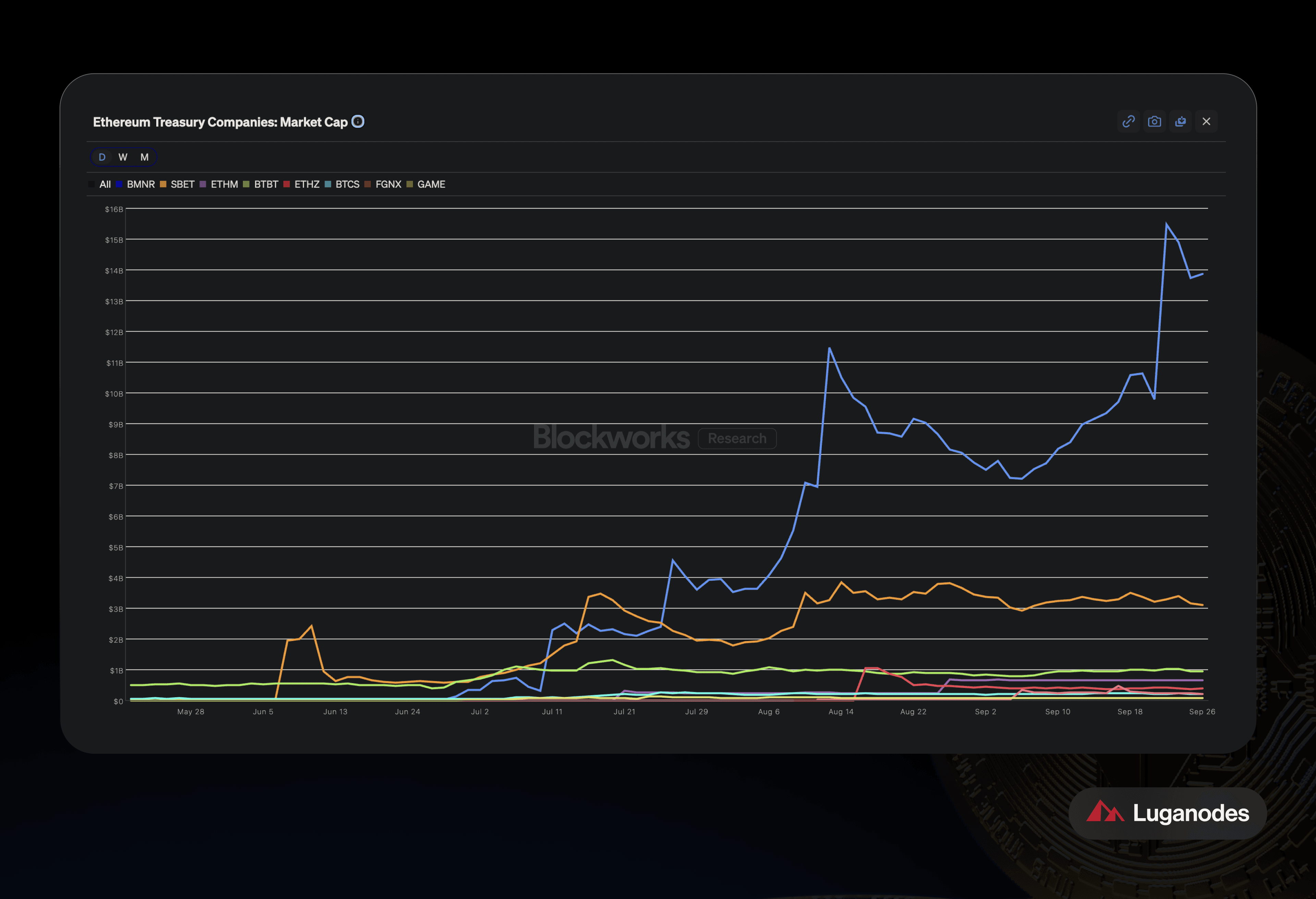

Over the last couple of months, Bitmine has appeared in news cycles six separate times, each time with a holding value higher than before. Sharplink Gaming brands itself as the largest publicly traded company with ETH as its primary holding, even providing a dashboard to transparently track its reserves.

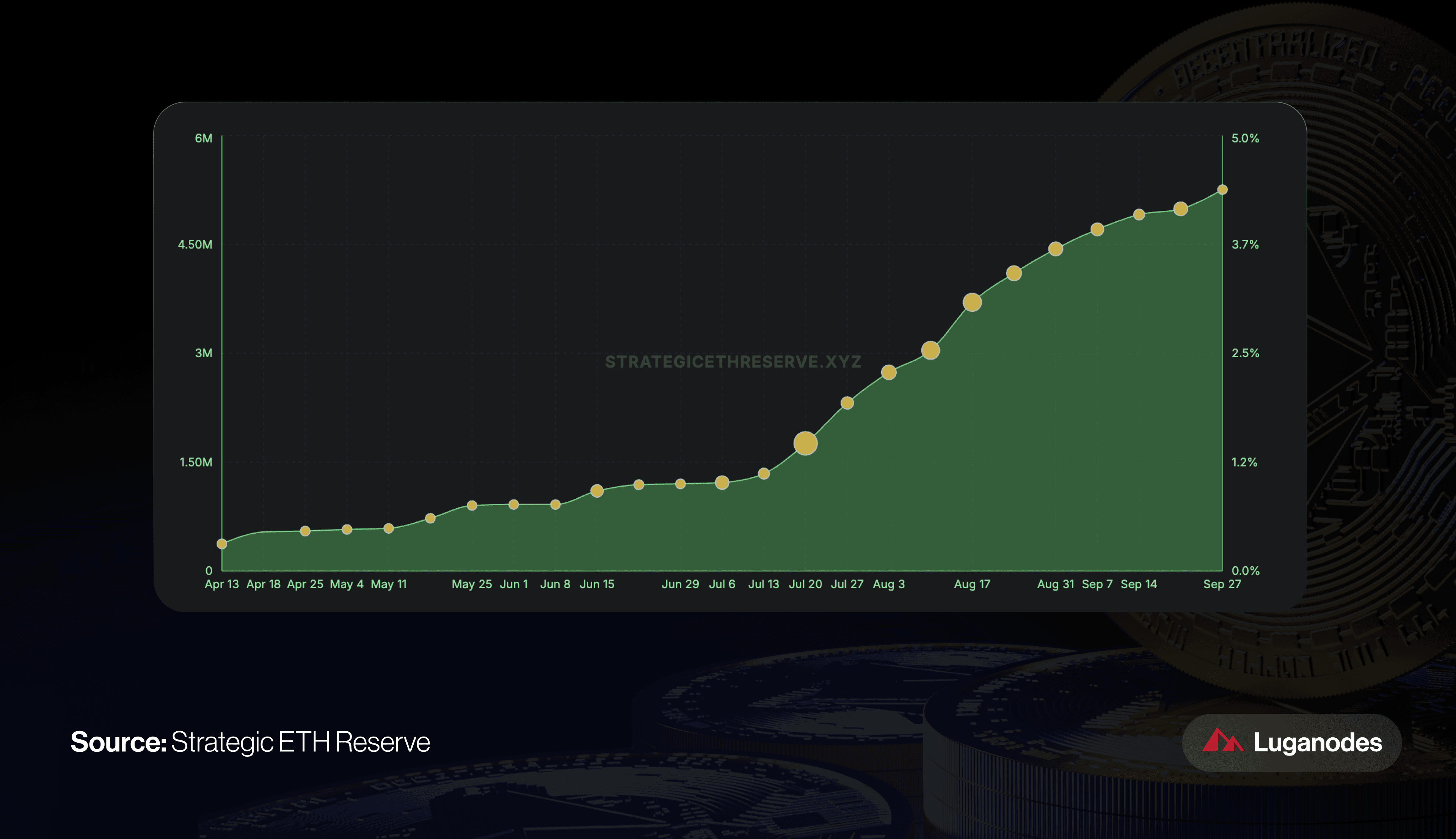

Before April 2025, ETF reserves held 3.5M ETH. In merely six months, that gap closed significantly, with 6.7M ETH in ETF reserves and ~5M ETH in ETH Treasuries. Together, these institutional ventures now hold 10% of the total ETH supply.

In fact, just the top 10 public companies holding ETH cumulatively account for 2.84% of ETH’s supply. And this trend continues, with more players opting for strategic reserves and established players acquiring more tokens than ever. 2025 marks the emergence of ETH’s institutional treasury adoption in a big way.

What Are ETH Treasuries?

In traditional finance, corporate treasuries often hold reserves in cash, bonds, or commodities like gold to preserve value and manage liquidity. ETH Treasuries are the Web3 equivalent of this practice: publicly traded companies allocate part of their balance sheet to Ethereum, treating it as a strategic reserve asset. For investors, exposure comes indirectly, by buying shares of these companies, much like owning stock in a gold miner offers exposure to gold.

It’s important to distinguish this from ETFs. An Ethereum ETF is a regulated fund that passively holds ETH on behalf of investors, but does not generate staking yield. By contrast, ETH Treasuries can actively manage their holdings—staking tokens, reinvesting rewards, or using ETH in financing strategies. This makes them not just a proxy for Ethereum’s price, but a way to benefit from its productive capacity as well.

ETH Treasuries: The New Frontier of Corporate Finance

“The Wall Street Token,” as phrased by Jan van Eck, while being a powerful endorsement of Ethereum, gives us a lot more to unpack. The statement encapsulates traditional finance’ acceptance of Ethereum as an essential part of the financial system, shedding the image of a speculative asset. This brings us to the next point: why Ethereum specifically?

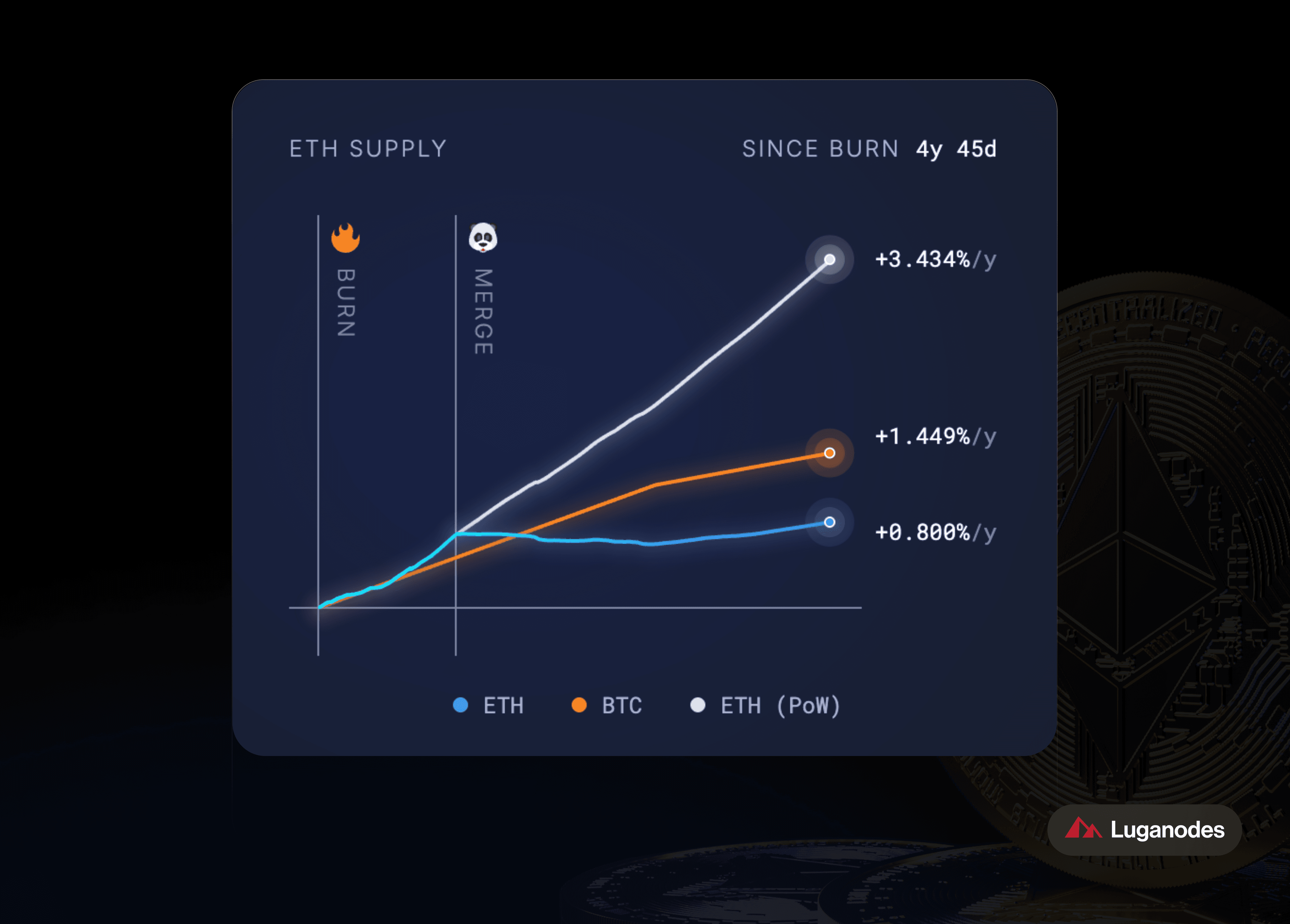

Bitcoin is the first token to find adoption from the global investor community, given its familiarity, scarcity and position as the digital gold. But Ethereum with the Proof of Stake(PoS) approach, has a very different approach. A much more dynamic token, which happens to be not just a store of value but also a yield-bearing asset. As OKX notes, this makes ETH Treasuries more “productive.” What tilts the playing field are staking rewards.

Value Storage + Staking Yields

ETH’s smart-contract ecosystem lets corporations do more: they can stake, lend, or use ETH in real-world asset tokenization, generating yield and utility. Standard Chartered likewise predicts that ETH treasuries will generally outperform BTC peers because they can earn staking reward yields. With its dominance in tokenized assets and stablecoins, it also enables investors to further tap into the DeFi ecosystem around it. In fact, this is also the reason why many companies are moving away from ETF exposure, since they do not provide staking yields as of now.

Global Settlement Layer

Beyond the prospect of price gains, the primary reasons for companies choosing ETH center on its broad utility. Ethereum's network serves as a global settlement layer for digital payments, which is faster and cheaper than traditional systems like SWIFT. Its smart contract functionality allows companies to automate processes such as rewards and compliance.

Dynamic Asset

The network's monetary policy also makes it an attractive hedge against inflation. The London Hard Fork (EIP-1559) introduced a mechanism that permanently removes a portion of transaction fees from circulation, creating deflationary pressure that reduces the overall supply of ETH over time. This dynamic, which occasionally makes ETH outright deflationary during periods of high network usage, is a powerful draw for corporate treasuries concerned with the devaluation of fiat currency.

All these factors have triggered a relentless accumulation of ETH by corporate treasuries. Predictions from Standard Chartered show that corporate treasuries could eventually hold up to 10% of all ETH in circulation. This sustained, aggressive accumulation, combined with robust ETF inflows, is creating a powerful supply squeeze that could act as a major catalyst for price appreciation, further strengthening the value of the token.

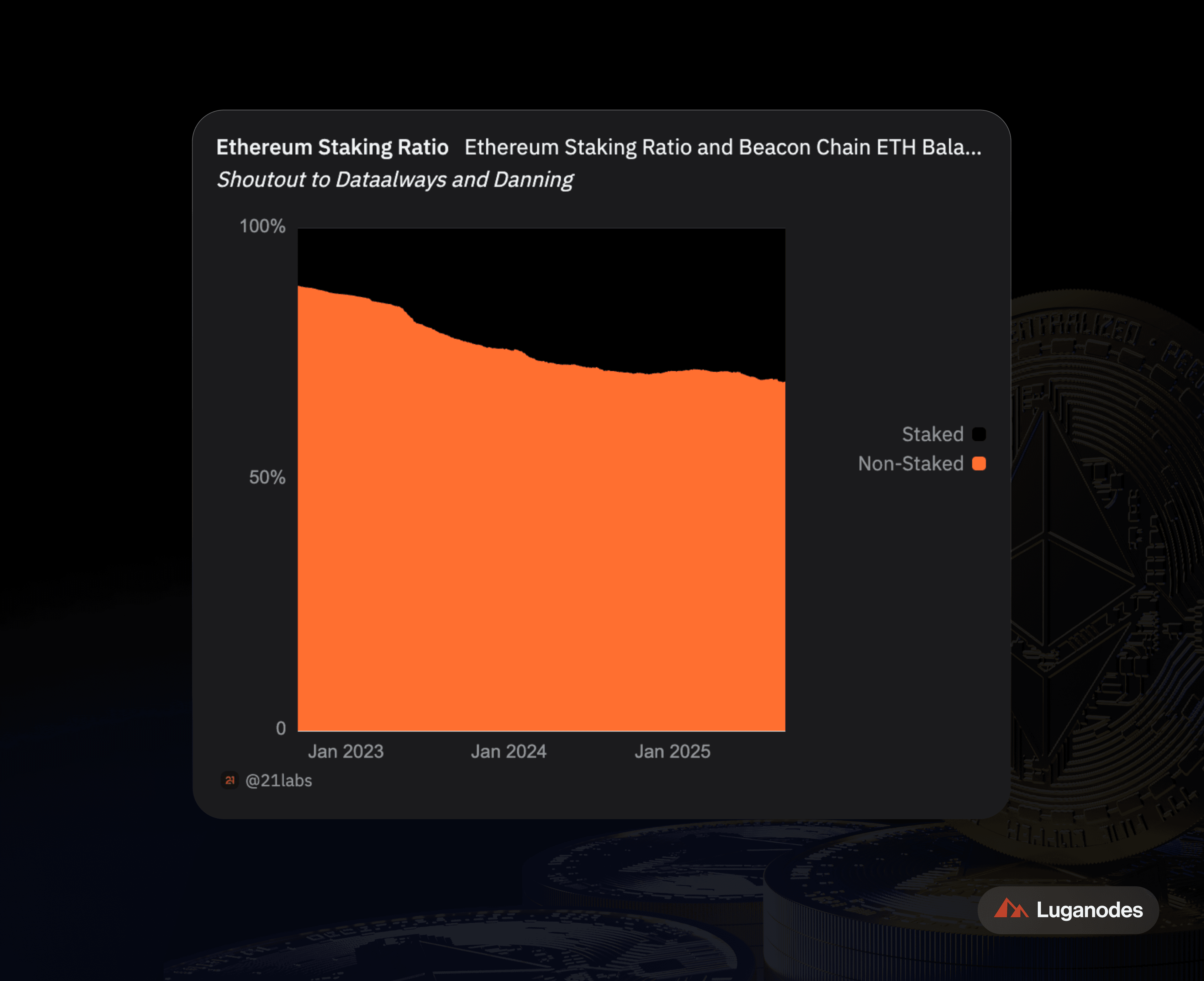

Staking: The Engine of Value

The ability to generate yield through staking is the single most important financial and strategic differentiator for Ethereum treasuries when compared to their Bitcoin counterparts. This functionality transforms a passive balance sheet asset into an active, income-generating one, creating a new source of revenue that traditional treasury assets cannot match.

Staking allows companies to earn a new, consistent revenue stream from their treasury holdings. The average annual percentage yield (APY) for institutional staking is cited to be in the range of 3% to 5%. For a corporate treasury with billions in assets, this yield can translate into a significant new source of income that can be used to fund operations, finance new purchases, or even return capital to shareholders through dividends or stock buybacks.

mNAV

This yield-bearing property ties directly to a core valuation metric: market-to-net-asset value (mNAV). An mNAV above 1 enables treasuries to issue shares and expand their holdings, while a drop below that level restricts growth. Standard Chartered’s Geoffrey Kendrick notes that Ethereum treasuries should consistently command higher mNAVs than Bitcoin peers because staking yields—estimated to add 0.6 points—directly strengthen balance sheets. This structural advantage makes ETH treasuries more sustainable and positions them to keep accumulating even in volatile markets.

Catalysts for Institutional Acceleration

The rise of corporate Ethereum treasuries is the product of a multi-year convergence of technical upgrades, regulatory clarity, and market shifts. A timeline of milestones helps explain why the strategy is accelerating now.

-

August 2021 – London Hard Fork (EIP-1559): Introduced fee burning, making ETH supply more predictable and potentially deflationary. This “ultrasound money” model established verifiable scarcity, an institutional prerequisite.

-

September 2022 – The Merge: Transition to Proof-of-Stake cut energy use by 99.9%, solving ESG concerns while enabling staking yields. ETH became both a store of value and an income-generating asset, setting it apart from Bitcoin treasuries.

-

July 2024 – U.S. Spot ETF Approvals: Opened a regulated on-ramp for capital inflows. Flagship funds quickly amassed billions, legitimizing ETH in the eyes of institutions.

-

July 2025 – The GENIUS Act: Provided a regulatory framework for stablecoins, with banks now compelled to adopt blockchain rails, where Ethereum is a leading candidate.

Together, these events created a self-reinforcing flywheel: technical and ESG breakthroughs attracted attention, regulatory clarity unlocked capital, and corporate buying intensified. In fact, corporate treasury accumulation has recently outpaced ETF inflows, underscoring that this is not a passing trend but the structural adoption of Ethereum as a productive treasury asset.

Architects of Change: The Players

Several publicly traded firms have embraced Ethereum as a key treasury asset, combining accumulation, staking, and strategic investments:

BitMine Immersion Technologies (NYSE: BMNR)

Originally a Bitcoin miner, BitMine has reinvented itself around Ethereum. Its strategy, described internally as the “alchemy of 5%,” aims to accumulate and stake a significant share of the ETH supply. Unlike MicroStrategy’s passive Bitcoin holding model, BitMine’s approach is yield-driven, with plans to earn staking rewards and finance ongoing accumulation through equity raises and institutional partnerships.

SharpLink Gaming (Nasdaq: SBET)

SharpLink transitioned from a sports-betting firm into one of the most aggressive corporate ETH acquirers. The company benefits from the leadership of Ethereum co-founder Joseph Lubin, who now chairs its board. Its strategy goes beyond balance-sheet exposure, integrating Ethereum into its core Web3 gaming and betting operations while maintaining a near-total staking rate on its treasury.

Coinbase Global (Nasdaq: COIN)

As the largest U.S. crypto exchange, Coinbase holds ETH on its balance sheet to support liquidity, staking services, and platform operations. ETH reserves are integral to its business model but serve operational needs rather than being a speculative treasury-first play.

Bit Digital (Nasdaq: BTBT)

Once a Bitcoin mining company, Bit Digital has pivoted toward Ethereum by accumulating ETH and using it to run validators and staking infrastructure. Its treasury now underpins a shift into institutional-grade staking services.

ETHZilla (Nasdaq: ETHZ)

ETHZilla rebranded as a blockchain infrastructure and treasury company centered on Ethereum. It combines on-chain staking and DeFi partnerships with traditional treasury tools like cash reserves and share buybacks, positioning itself as a hybrid between a corporate holder and an active ETH yield vehicle.

BTCS Inc. (Nasdaq: BTCS)

A pure staking services company, BTCS runs validators across proof-of-stake networks and uses its ETH holdings to generate staking income. Its NodeOps platform integrates treasury management with infrastructure services.

Fundamental Global / FG Nexus (Nasdaq: FGNX)

A merchant bank that has added Ethereum to its reserves, FG Nexus actively pursues staking and restaking strategies to maximize yield. It has outlined ambitions to control a meaningful share of validator activity on the network.

The Ether Machine (planned Nasdaq: ETHM)

Launched through a SPAC merger, The Ether Machine is designed as a large-scale Ethereum treasury and yield vehicle. Its strategy centers on accumulation, staking, and DeFi deployment, positioning it as a publicly traded proxy for ETH exposure.

GameSquare Holdings (Nasdaq: GAME)

A media and entertainment firm that uses Ethereum strategically within its treasury. Staking yields are directed toward shareholder value programs such as stock repurchases, integrating blockchain finance with traditional capital markets practices.

Intchains Group (Nasdaq: ICG)

A Singapore and China based blockchain hardware company that has gradually accumulated ETH as part of its balance sheet. Its approach is conservative, using ETH reserves for diversification and staking income.

Exodus Movement (Nasdaq: EXOD)

A crypto wallet developer that holds Ethereum primarily for operational and ecosystem purposes. ETH supports liquidity for wallet services and staking integration, rather than serving as a dedicated treasury reserve.

Conclusion

For large treasuries holding significant ETH reserves, staking introduces serious operational and security considerations. Running validators in-house is complex, and most corporations prefer to rely on professional infrastructure providers to manage risk and ensure compliance.

Luganodes has long operated in the institutional staking space, partnering with leading financial institutions, custodians, and exchanges. Trusted by clients such as Bitfinex, Bitpanda, Hex Trust, and BitGo, Luganodes delivers institutional-grade validator services that help organizations securely capture staking yields.

As corporate treasuries begin adopting Ethereum strategies at scale, Luganodes sees this as a natural extension of its work in institutional staking. The same infrastructure trusted by exchanges and custodians can support treasuries in turning ETH from a passive reserve into productive capital, assets that both preserve value and generate sustainable returns.

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.